W2 Tax Form 2025 – Obtain a copy of your W2 form to ensure accurate tax filing and avoid potential issues with the IRS. You may need this important document for various financial applications, so it’s important to act promptly. If you haven’t received your W2 from your employer or have misplaced it, there are specific steps you can take to retrieve it easily. From contacting your employer to utilizing IRS resources, we will guide you through the process to ensure you have the necessary information at your fingertips.

Key Takeaways:

- W-2 Form Definition: The W-2 form is a tax document that reports an employee’s annual wages and the amount of taxes withheld from their paycheck.

- Employer Responsibility: Employers are required to provide W-2 forms to their employees by January 31st of each year for the previous tax year.

- Accessing Copies: If you did not receive your W-2, contact your employer directly to request a copy.

- Online Access: Many employers offer electronic access to W-2 forms through payroll service portals; log in to ensure you can find your document online.

- IRS Services: If you’re unable to obtain a copy from your employer, you can request a copy from the IRS using Form 4506-T.

- State Requirements: Check your state’s tax authority for any specific requirements regarding W-2 forms, as they may have different processes.

- Deadline Awareness: Be mindful of tax filing deadlines to avoid delays in receiving your refund or facing penalties.

Understanding W2 Forms

Your W2 Form is imperative documentation that summarizes your annual earnings and the taxes withheld from your paycheck. This form is provided by your employer and is crucial for accurately reporting your income to the IRS. Additionally, it plays a vital role in determining your eligibility for various tax credits and filing your tax return correctly.

What is a W2 Form?

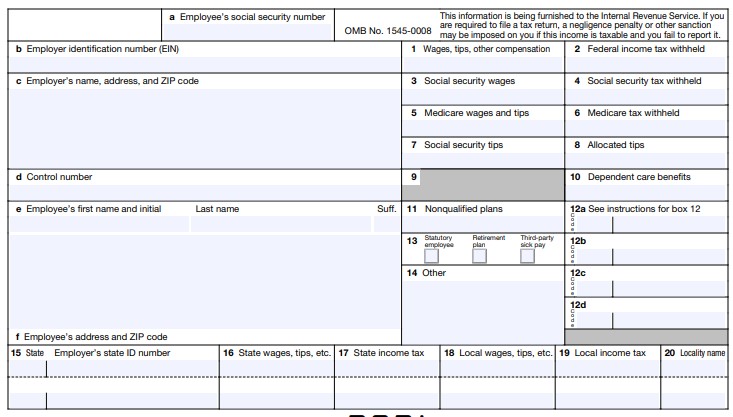

Around the United States, a W2 Form is the Internal Revenue Service (IRS) document that employers use to report an employee’s annual wages and the taxes withheld. The form includes your earnings for the year and amounts withheld for federal, state, and other taxes, making it an imperative part of your tax filing process.

Importance of W2 Forms

Behind every tax return you file, the W2 Form serves as a vital tool that ensures accuracy in reporting your earnings. It helps you and the IRS account for your income and tax obligations, enabling you to file correctly and avoid potential issues with the tax authorities.

Hence, the significance of W2 Forms cannot be overstated. They provide not only a summary of your annual income but also a clear record of the taxes withheld, aiding you in potential tax refunds or liabilities. A missing or incorrect W2 can lead to filing errors that may attract IRS scrutiny, impacting your financial standing. Therefore, having an accurate W2 Form ensures that you claim the correct deductions, ultimately protecting your financial interests.

Who Needs a Copy of Their W2 Form?

It is important for anyone who earns income in the United States to have access to their W2 form. This document serves as proof of earnings and is imperative for filing tax returns accurately. Individuals who receive wages, salaries, or tips are typically required to obtain their W2 forms to ensure proper tax reporting and payment.

Employees

An employee should obtain a copy of their W2 form from their employer as it outlines the wages earned and the taxes withheld throughout the year. This document is necessary for filing your annual tax return, and it helps you accurately report your income and ensure that you’ve paid the appropriate amount in taxes.

Freelancers and Contractors

Any freelancer or contractor who earns income must keep track of their earnings, and while they may not always receive a W2 form, they may instead receive a 1099 form. This form details payments made to independent workers and is also used for tax reporting. It’s imperative for you to obtain these documents to complete your tax return correctly.

Another important aspect to note is that as a freelancer or contractor, you might receive multiple 1099 forms if you have worked with several clients throughout the year. Each form lists payments made to you, ensuring you accurately report your total income. If you do not receive these forms, it is your responsibility to contact your clients and request copies. Missing out on this documentation could lead to underreporting your income and potentially causing issues with the IRS. Stay organized to maintain your financial health.

Ways to Obtain a Copy of Your W2 Form

Keep in mind that obtaining a copy of your W2 form can be done through various methods, making it easier for you to retrieve your important tax information. Whether it’s from your employer, online payroll services, or through the IRS, there are multiple avenues available to ensure you have access to your W2 form when you need it.

From Your Employer

About your W2 form, the first step is to contact your employer’s human resources or payroll department. They are typically responsible for issuing W2 forms and can provide you with a copy if you’ve misplaced yours. Make sure to have your personal information handy, as they may need to verify your identity.

Online Access through Payroll Services

After confirming your employment status, you may be able to access your W2 form online through your payroll service provider’s portal. Many companies now utilize digital payroll services, allowing you to view and download your W2 form at your convenience.

Due to the increasing adoption of technology in payroll management, many employers use platforms that provide immediate online access to your W2 forms. By logging into your payroll service account, you can easily download a PDF version of your W2. Ensure you have your login credentials, as losing access could delay your ability to retrieve your form. If you encounter technical issues, their customer support is generally helpful. This digital approach also streamlines the process for obtaining a copy when needed, reducing the chances of misplacing physical documents.

Requesting a Copy from the IRS

Many individuals find themselves needing a copy of their W-2 form at some point. If you are unable to obtain it from your employer, the IRS can provide a copy upon request. You’ll need to ensure your request is filled out correctly to avoid any delays. The IRS keeps your tax records, so reaching out to them can be a straightforward solution.

How to File a Form 4506-T?

Form 4506-T is your official request to obtain a transcript of your tax return, which includes W-2 information. You can file this form online, via mail, or by fax. Be sure to provide accurate personal information to facilitate a prompt response from the IRS.

Timeframe for Receiving Your Copy

Between submitting your Form 4506-T and when you receive your copy, the processing time can vary. Typically, the IRS may take up to 10 business days to process your request and send you the necessary documents.

Considering the effective resolution of your request, it’s important to plan accordingly. While the IRS generally acts within ten business days, factors such as high request volumes or processing delays can hinder this timeframe. To ensure a smoother process, submit your form fully completed and during off-peak times, if possible. If extensive delays occur, consider following up to check the status of your request.

Common Issues and Solutions

Once again, obtaining your W2 form may not be a seamless process, and you might encounter some issues along the way. Addressing these common problems promptly can help you avoid delays in filing your taxes. From missing forms to incorrect information, there are solutions available that ensure you receive the accurate documentation needed to comply with tax regulations.

Missing W2 Forms

Common reasons for missing W2 forms include changes in employment, postal issues, or employer errors. If your W2 hasn’t arrived by mid-February, contact your employer’s HR department and verify that your address is correct in their records. If necessary, you can also reach out to the IRS for assistance after attempting to obtain it from your employer.

Incorrect Information on W2s

Around tax season, you may notice that your W2 has incorrect information which could cause issues with your tax filings. Errors might include misspelled names, wrong Social Security numbers, or incorrect amounts, which can lead to complications with the IRS.

To correct any incorrect information on your W2, you should first contact your employer to request a revised version of the form. They are obligated to issue corrected forms if there are discrepancies. In case your employer fails to resolve the issue, you can still file your tax return using Form 4852 as a substitute for your W2, while noting the discrepancies and providing documentation if needed. Always ensure all your personal details match your tax records to avoid complications in the future.

Keeping Your W2 Information Secure

Despite the importance of your W2 form for tax purposes, it’s vital to keep this sensitive information secure. W2 forms contain personal details, such as your Social Security number, that can be exploited by identity thieves. By following best practices, you can protect your data from unauthorized access and ensure that your financial information remains private.

Importance of Data Security

For individuals, protecting W2 information is fundamental to avoiding identity theft and fraud. Unauthorized access can lead to serious consequences, including financial loss and complications with tax filings. Ensuring the security of your personal data should always be a top priority.

Best Practices for Handling W2 Forms

One effective way to handle W2 forms securely is to store them in a safe place. Avoid leaving your W2 forms in areas easily accessible to others, and consider using a locked file cabinet or digital password protection for electronic copies.

This includes regularly monitoring your financial accounts for any suspicious activity and shredding any physical copies of your W2 once you no longer need them. Storing your W2 information securely and discarding unneeded documents safely are important strategies in preventing identity theft. You should also ensure that you discuss your W2 details only with trusted tax professionals or family members to minimize exposure to potential risks.

Taking this into account, obtaining a copy of your W2 form can be a straightforward process. You can request it directly from your employer, who is obligated to provide you one annually. If you cannot get it from your employer, the IRS can furnish a copy if you fill out Form 4506-T. Additionally, checking your online payroll platform, if available, may give you instant access to your tax documents. Following these steps ensures you have the necessary documentation for your tax filing accurately and on time.

FAQ

1. What is a W-2 form and why do I need it?

W-2 form, officially known as the Wage and Tax Statement, is a document that employers in the United States must send to their employees and the Internal Revenue Service (IRS) at the end of each tax year. It details the wages earned by the employee and the taxes withheld from their paycheck. You need the W-2 form to accurately file your income tax return.

2. How can I obtain my W-2 form from my employer?

To obtain your W-2 form from your employer, you should first check your employer’s payroll department or HR representative. Many employers provide electronic access to W-2 forms via online payroll systems. If you cannot find your form online, contact your employer directly and request a copy. They are legally required to provide it to you by January 31st each year.

3. What should I do if my employer has not sent my W-2 form?

If your employer has not sent your W-2 form by the end of January, reach out to them to inquire about the delay. It’s possible they may have encountered an issue with processing or mailing. If you still cannot get your W-2 by mid-February, you can reach out to the IRS at 1-800-829-1040 for assistance. Be prepared to provide information about your employment, including your name, address, and Social Security number.

4. Can I access my W-2 form online if my employer has a digital payroll system?

Yes, many employers now utilize digital payroll systems that allow employees to access their W-2 forms online. If your employer offers this service, you will typically be able to log in to the payroll platform, locate your W-2 form for the relevant tax year, and download or print it. Check with your employer’s payroll department for specific instructions.

5. What if I lost my W-2 form or never received it?

If you lost your W-2 form or never received it, contact your employer’s HR or payroll department to request a duplicate. They can issue you a new copy. If you are unable to secure a duplicate before tax filing, you might be able to use your last pay stub of the year to estimate your earnings and taxes withheld, though this method should be used with caution.

6. What steps should I take if I’ve moved and need a W-2 from a previous employer?

If you’ve moved and require a W-2 from a previous employer, contact the HR department of that company, providing your new address and relevant identification information. They are obligated to send you a copy of your W-2. Additionally, you may need to fill out a request form or submit a dated request via email or mail for record-keeping purposes.

7. Are there any penalties for failing to provide a W-2 form when filing taxes?

Failing to provide a W-2 form when filing taxes can lead to complications with the IRS. If you are unable to submit a W-2, you may need to file your taxes using Form 4852, which serves as a substitute for the W-2. Not having the accurate information can delay your tax return processing. It can also result in underreporting your income, leading to potential penalties or interest on unpaid taxes. Always strive to include the correct documents when filing.