W2 Tax Form 2025 – You may have noticed a deduction labeled CASDI on your W-2 form and wondered what it means. CASDI stands for California State Disability Insurance, which provides benefits to eligible workers who become disabled and cannot perform their job. It’s important to understand that this deduction contributes to a program designed to protect your income in case of unforeseen health issues. Staying informed about CASDI ensures that you are equipped for any unexpected challenges that may arise in your working life.

Key Takeaways:

- CASDI stands for California State Disability Insurance, a program that provides partial wage replacement for eligible workers who are unable to work due to non-work-related injuries or illnesses.

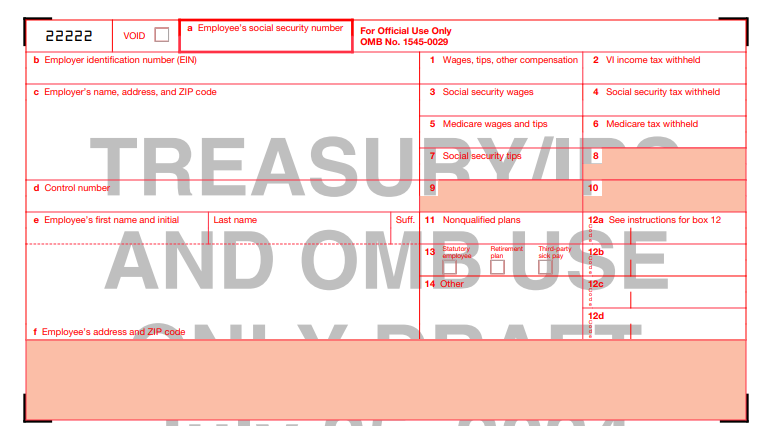

- W2 Form is the annual tax document that reports an employee’s total wages and the amount of taxes withheld from their paycheck, including deductions for CASDI.

- The CASDI deduction is typically listed in Box 14 of the W2 Form, showing how much was withheld from the employee’s wages for the program during the tax year.

- Employees in California are automatically enrolled in the CASDI program, with deductions taken from their paychecks unless they opt-out under specific circumstances.

- The benefit amount received from CASDI may vary based on the employee’s covered earnings, and there is a maximum weekly benefit limit set by the state.

- In order to access CASDI benefits, employees must file a claim and meet certain eligibility criteria, including having sufficient earnings and a qualifying disability.

- Understanding CASDI and its implications on the W2 Form is important for employees to accurately report their income and taxes when filing their annual tax returns.

Understanding CASDI

To comprehend CASDI, it is vital to understand its role in California’s state disability insurance program. CASDI stands for California State Disability Insurance, which is a wage replacement program designed to provide financial support in the event of a non-work-related illness or injury that prevents you from working. It is an integral part of the state’s workforce support system, ensuring that you have some level of income during difficult times.

Definition of CASDI

CASDI refers to California State Disability Insurance, a program that offers partial wage replacement to eligible workers who are unable to work due to disabilities that are not job-related. This program is funded through payroll deductions, which you will typically see on your W-2 form.

Purpose of CASDI

CASDI aims to provide financial assistance to support you during periods when you are unable to earn income due to qualifying medical conditions. The program alleviates the financial burden during your recovery, offering a safety net when you need it most.

In fact, CASDI is designed to help you maintain a semblance of financial stability while you are unable to work. By replacing a portion of your wages (up to 70% of your earnings depending on your income level), this program allows you to focus on your health and rehabilitation without the additional stress of lost income. Qualifying conditions for CASDI can include debilitating illnesses, surgeries, or pregnancy-related disabilities, making it a valuable resource for many individuals.

CASDI on the W2 Form

Clearly, CASDI, or California State Disability Insurance, is an important component reflected on your W2 form. This deduction signifies your contributions to the state’s disability insurance program, which provides benefits if you become unable to work due to a non-work-related injury or illness. Understanding how CASDI appears on your W2 can help you grasp your tax obligations and the benefits you may qualify for in the future.

Location of CASDI on W2

At your W2 form, you will find CASDI contributions listed in Box 14, which is designated for other non-taxable information. This will detail the amount deducted from your earnings specifically for the CASDI program throughout the year, ensuring transparency in your disability insurance contributions.

Importance of CASDI Reporting

CASDI plays a significant role in your financial well-being. This reporting allows you to see how much you’ve contributed to the program, which in turn, affects your eligibility for disability benefits. If you are ever unable to work due to a qualifying condition, this contribution becomes vital in providing you with the necessary support.

And understanding the significance of this reporting helps you plan for the unforeseen. If you ever face a temporary disability, knowing you’ve consistently contributed to CASDI enables you to access monthly benefits during your recovery. It is also vital for ensuring that you receive the correct benefits based on your contribution history. Keeping accurate records not only aids in this process but also arms you with knowledge in case of any potential discrepancies.

Impact of CASDI Deductions

For employees in California, the CASDI (California State Disability Insurance) deductions can have a noticeable impact on your overall earnings. These deductions help fund the state’s disability programs, but they do reduce the amount you take home each pay period. Understanding this impact is vital for budgeting and financial planning as you might find yourself adjusting your lifestyle to account for these deductions.

How CASDI Affects Take-Home Pay

CASDI deductions reduce your take-home pay by a small percentage of your gross wages. Although this may seem insignificant in the short term, it contributes to funding disability coverage, which can lead to financial stability during periodic work absences due to illness or injury. Hence, you’ll want to be aware of how these deductions impact your overall financial situation.

Long-Term Benefits of CASDI

Around every corner, you may face unexpected health issues or accidents that could affect your ability to work. The California State Disability Insurance program provides you with financial support during these times, easing your stress when you need it most. You can rely on these benefits to help cover your living expenses, allowing you to focus on recovery without the added burden of lost income.

CASDI not only serves as a safeguard during challenging times but also fosters a culture of security and resilience. Should you become disabled, having CASDI benefits available can prevent a financial crisis, enabling you to maintain your quality of life. As you contribute to this program, you are making a valuable investment in your future well-being, ensuring that you have a safety net that supports you when you need it the most.

Eligibility for CASDI Benefits

Despite being a valuable safety net, eligibility for California State Disability Insurance (CASDI) benefits depends on specific criteria. You must have contributed to the program during your employment and have a qualifying disability that prevents you from performing your regular work. Furthermore, you must be unable to work for a minimum of eight consecutive days and provide necessary medical documentation to support your claim.

Who Qualifies for CASDI?

Before applying for CASDI benefits, it’s important to review the qualifying conditions. Generally, you qualify if you have earned enough wages in an eligible job in California and have paid into the CASDI program. Your disability must also be certified by a medical professional, and you must be unable to work due to a non-work-related injury, illness, or pregnancy-related condition.

How to File for CASDI Benefits

The process of filing for CASDI benefits involves several steps to ensure your claim is successful. You will need to gather your employment history, medical documentation, and complete the application within the appropriate timeframe following your disability onset.

To officially file for CASDI benefits, you should start by visiting the California Employment Development Department (EDD) website. Here, you can access the online application or download the necessary forms. Ensure that you provide accurate and comprehensive information regarding your earnings, employment, and medical history. Submit your application as soon as possible, and be prepared to follow up with any additional information requested by the EDD to expedite your claim processing.

Common Questions about CASDI

Now, you might have several questions regarding CASDI and how it affects your W-2 form. It’s vital to understand this deduction, as it pertains to your income and potential benefits. Whether you’re wondering about the eligibility criteria, the impact on your taxes, or how to find your CASDI contributions, having clarity can help you better manage your finances.

Frequently Asked Questions

Between various work scenarios and unique financial situations, you may have specific queries about CASDI. It’s typical to consider how CASDI contributions may influence your overall earnings and benefits. If you have personal concerns about the amount deducted or the benefits you’re entitled to, seeking clear answers can help guide your financial decisions.

Resources for Further Information

At your disposal are numerous resources that provide in-depth information about CASDI. You can start by visiting the California Employment Development Department’s (EDD) official website, where detailed explanations about your contributions and benefits are available. Additionally, consulting a tax professional or financial advisor can equip you with personalized insights into your situation.

Hence, utilizing these resources can significantly enhance your understanding of CASDI and its implications on your taxes and benefits. Engaging with the official EDD website not only clarifies your inquiries but also ensures you access the most reliable and updated information. Consulting a tax professional can further help you navigate your specific financial landscape, ensuring you make informed choices and fully leverage available benefits. Empower yourself with knowledge to maximize your financial well-being.

To wrap up

Conclusively, CASDI on your W-2 form refers to the California State Disability Insurance, which is a mandatory program that provides partial wage replacement for employees unable to work due to disabilities. When you see CASDI deductions on your W-2, it indicates contributions you’ve made towards this insurance throughout the year. Understanding how CASDI impacts your finances can help you better prepare for any potential disability claims in the future, ensuring you are aware of the support available to you as a California worker.

FAQ

1. What does CASDI stand for on my W2 form?

CASDI stands for California State Disability Insurance. It is a payroll deduction that provides partial wage replacement benefits to eligible employees who are temporarily unable to work due to a non-work-related illness or injury.

2. Why is CASDI listed on my W2 form?

CASDI is reported on your W2 form to indicate the amount withheld from your wages for California State Disability Insurance during the tax year. This information is necessary for both state and federal tax purposes and helps to inform you about your deductions.

3. How is CASDI calculated?

CASDI contributions are typically calculated as a percentage of your earnings. For the year 2023, the contribution rate is set by the state of California and may change annually. The maximum taxable earnings subject to CASDI withholding also fluctuates each year.

4. Can I opt out of paying CASDI?

Generally, employees working in California are required to contribute to CASDI unless they meet certain criteria for exemption. For example, some government employees or specific types of workers may be excluded. If you believe you qualify for exemption, consult your employer or review the California Employment Development Department (EDD) guidelines.

5. What benefits does CASDI provide?

CASDI provides financial assistance to eligible employees who are unable to work due to a non-work-related illness or injury. The benefits can include wage replacement for up to 52 weeks, depending on the severity of the condition and the employee’s eligibility.

6. How do I claim CASDI benefits?

To claim CASDI benefits, you need to file a claim with the California Employment Development Department (EDD) as soon as you are unable to work due to a qualifying condition. The claim can be filed online, by mail, or via phone. You will need to provide necessary documentation to support your claim.

7. What should I do if I see an error in my CASDI amount on my W2?

If you notice a discrepancy in the CASDI amount reported on your W2 form, first consult with your employer or payroll department to address the issue. They can verify your earnings and contributions. If necessary, they can issue you a corrected W2 (Form W-2c) to reflect the accurate information.