W2 Tax Form 2025 – There’s a lot to consider when it comes to receiving your W-2 form, a key document for filing your taxes. Typically, you can expect your employer to provide this form by January 31st of each year, ensuring you have the necessary information to report your earnings and taxes withheld. If you haven’t received it by mid-February, it’s vital to reach out to your employer, as not having this form can delay your filing process and tax refund. Stay informed to avoid any complications with your taxes!

Key Takeaways:

- W2 Form Deadline: Employers must send out W2 forms by January 31 of each year.

- Tax Filing: You need the W2 form to file your federal tax return.

- Electronic Distribution: Many companies now provide W2s electronically, allowing for easier access.

- Multiple Employers: If you’ve had more than one job, expect a W2 from each employer.

- Address Check: Ensure your employer has your correct address to avoid delays in receiving your W2.

- Lost W2 Forms: If lost, you can request a replacement from your employer or access it through your online account.

- IRS Resources: The IRS provides guidance and assistance for any issues related to W2 forms.

Understanding the W-2 Form

While navigating the world of taxes and income reporting, it’s necessary to fully understand the significance of the W-2 form. This document not only reflects your earnings but also plays a vital role in how you file your taxes each year. By grasping its components, you’ll be better prepared to manage your finances and optimize your tax return.

What is a W-2 Form?

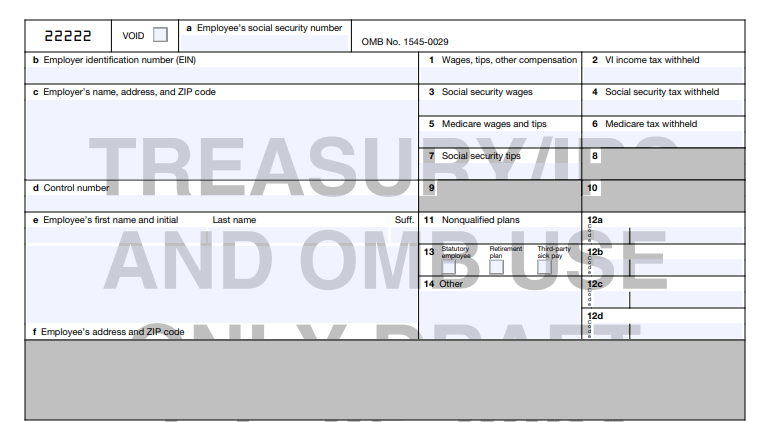

Below is a detailed overview: the W-2 form is an official statement provided by your employer that reports your annual wages and the taxes withheld from your paycheck. You’ll receive this form at the start of every year, outlining your earnings for the previous one, which you will use when filing your income tax return.

Why is the W-2 Form Important?

By receiving your W-2 form, you gain access to necessary information that impacts your tax obligations and potential refunds. This form contributes directly to your ability to report accurate income to the IRS, ensuring compliance and minimizing the risk of audits.

This W-2 form is integral in determining your tax liability and eligibility for certain credits or deductions. If you lose it or it contains errors, it could lead to delays in processing your tax return or even overpayment of taxes. Thus, it’s vital that you store it safely and verify all details for accuracy to avoid any future complications with the IRS.

Employers’ Responsibilities

If you’re an employer, providing W-2 forms to your employees is a key responsibility. You must ensure that these forms are accurately completed and delivered on time, as they outline your employees’ earnings and tax withholdings for the year. Failing to fulfill this duty can lead to penalties and dissatisfaction among your staff, as they rely on this information to file their taxes correctly.

Legal Requirements for Issuing W-2s

An important aspect of issuing W-2s is understanding the legal requirements set by the IRS. Employers are obligated to provide a W-2 form to every employee who earned income during the tax year. This includes detailing the total wages paid, tips received, and the amount withheld for federal, state, and local taxes. Adhering to these regulations helps ensure compliance and protects both you and your employees from tax-related issues.

Winter Deadline: Key Dates to Remember

Behind the scenes, specific deadlines dictate when you must provide your W-2 forms to employees, as well as when they need to be submitted to the IRS. Knowing these dates is imperative for a smooth tax filing process.

Legal guidelines state that employers must deliver W-2 forms to their employees by January 31 of each year. Additionally, you must submit the copied forms to the IRS by the same deadline if filing by mail or by the end of March if filing electronically. Failure to meet these important timelines can result in penalties, including fines per W-2 form not submitted on time. Staying organized and adhering to these dates will ensure a better experience during tax season for you and your employees.

Employee Responsibilities

All employees have a responsibility to ensure that their employer has accurate and up-to-date information to facilitate the timely delivery of your W-2 form. This includes providing your current address and notifying your employer of any name changes. Keeping an open line of communication with your HR department can help prevent any issues related to W-2 distribution.

How to Ensure You Receive Your W-2

Receive your W-2 on time by verifying that your employer has your correct mailing address. You should also check your online payroll account, if available, as many employers provide electronic copies of W-2s. Additionally, keep track of your employment status and ensure you submit any necessary forms to your employer promptly.

What to Do if You Don’t Receive Your W-2

Before panicking, first check your mail and online accounts for your W-2. If it’s not there, reach out to your employer or payroll department for assistance. They can provide you with a duplicate if your original was lost or sent to an incorrect address.

Ensure you act quickly if you don’t receive your W-2. Contact your employer immediately to inquire about the missing form. If you still have not received it by mid-February, consider reaching out to the IRS for guidance. You may need to fill out Form 4852 as a substitute for your missing W-2 when filing your taxes. Always keep copies of any communication for your records to avoid potential issues with the IRS.

Common W-2 Issues

Despite the straightforward nature of W-2 forms, several common issues can arise that may confuse taxpayers. Misplaced or incorrect information, lost forms, and late delivery might lead to stress during tax season. Understanding how to address these problems is vital to ensure your tax filing process goes smoothly and accurately.

Incorrect Information on Your W-2

Your W-2 Form might contain errors such as misspelled names, wrong Social Security numbers, or incorrect income figures. If you notice any discrepancies, contact your employer immediately to request a corrected form. Timely action is necessary, as inaccuracies can delay your tax return and potentially trigger an audit.

Lost or Misplaced W-2 Forms

For many individuals, locating a lost or misplaced W-2 form can be a daunting task. If you cannot find your W-2, don’t panic; there are steps you can take to resolve the situation.

A good first step is to reach out to your employer or the payroll department to request a copy of your W-2. They are required to keep records, and they can send you a duplicate. If you are unable to obtain it from your employer, you can also file your taxes using your last pay stub of the year as a temporary solution. However, be sure to monitor for any corrections later, as the IRS requires you to eventually file an accurate W-2. If you’ve exhausted all options and you’re still missing your form, you may need to submit Form 4852, which acts as a substitute for the W-2, while providing estimates of your earnings and withholdings. The key is to take immediate action to mitigate any potential penalties from late filing.

W-2 Form Alternatives

Many employees may find themselves wondering about alternatives to the W-2 form when it comes to reporting income. While the W-2 is primarily used for traditional employment, there are other forms available depending on your employment status. Knowing these alternatives can help ensure proper tax reporting and compliance, ultimately guiding you through the complex maze of tax preparation.

1099 Forms vs. W-2 Forms

By understanding the differences between 1099 forms and W-2 forms, you can better navigate your tax responsibilities. While W-2 forms are issued to employees, 1099 forms are typically given to independent contractors and freelancers, showcasing non-employee compensation. This distinction is necessary for accurately reporting income and adhering to tax obligations.

Other Tax Forms for Different Employment Types

Below is a breakdown of alternative tax forms for various employment types. Familiarizing yourself with these forms enhances your ability to handle taxes efficiently and ensures compliance with IRS guidelines.

| Employment Type | Tax Form |

|---|---|

| Freelancer | 1099-MISC |

| Independent Contractor | 1099-NEC |

| Part-time Employee | W-2 |

| Self-Employed | Schedule C |

| Rental Income | Schedule E |

And various tax forms cater to different employment situations, ensuring that you report income accurately and eliminate potential issues with tax compliance. Depending on your work situation, utilizing the correct form is necessary for fulfilling your tax obligations.

- Freelancer – 1099-MISC

- Independent Contractor – 1099-NEC

- Part-time Employee – W-2

- Self-Employed – Schedule C

- Rental Income – Schedule E

Assume that you are aware of these forms, as it can significantly streamline your tax preparation process and help mitigate issues with the IRS.

Filing Taxes with Your W-2

Not every W-2 you receive will automatically ensure a smooth tax filing process. You need to understand how to accurately report the information on your W-2 to avoid potential issues with the IRS. Keeping your W-2 organized and ensuring all entries match with your income can make your tax preparation much easier.

How to Use Your W-2 for Tax Filing

An important step in filing your taxes is to locate your W-2 form, which details your earnings and tax withholdings for the year. When completing your tax return, enter the information from your W-2 into the corresponding sections on the tax form. Double-check that your numbers match, and consider using tax preparation software for guidance.

Common Mistakes to Avoid

Against popular belief, some common mistakes can lead to significant complications in your tax filing process.

Hence, you should watch out for incorrect information entry from your W-2. Providing wrong Social Security numbers or mismatched earnings can cause delays or audits. Additionally, overlooking additional income not reflected in your W-2 may lead to underreporting your total earnings, risking penalties. Lastly, neglecting to double-check tax withholdings could mean you owe money or miss out on a refund. Stay proactive in avoiding these mistakes to file your taxes effectively.

Final Words

Ultimately, you will typically receive your W-2 form by January 31st of each year, but it’s advisable to check with your employer for specific timelines. If you haven’t received it by mid-February, it’s important to follow up to ensure your tax filing isn’t delayed. Keeping your contact information updated with your employer can help avoid any issues. With your W-2 in hand, you’ll be prepared to accurately report your income when it’s time to file your tax return.

FAQ

1. When should I expect to receive my W-2 form?

Employers are required to send out W-2 forms to employees by January 31st of each year. If you haven’t received your W-2 by the first few days of February, it’s advisable to reach out to your employer’s payroll or human resources department for assistance.

2. Can I access my W-2 form online?

Yes, many employers offer electronic access to W-2 forms through a payroll system or an employee portal. If your employer provides this service, you can log in to your account and download your W-2 form. Check with your employer for specific instructions on accessing your form online.

3. What should I do if I lose my W-2 form?

If you lose your W-2 form, you should first contact your employer to request a duplicate copy. Employers are required to provide a duplicate upon request. If you’re unable to obtain a copy, you can also find your wages and tax information on your last pay stub of the year and use that for your tax filing, although it’s best to have the official W-2.

4. What happens if my W-2 form has incorrect information?

If you notice any errors on your W-2 form, such as incorrect earnings or tax withholdings, you should notify your employer immediately. They can issue a corrected W-2, known as a W-2c. Make sure to file your taxes using the corrected form to avoid any penalties or issues with the IRS.

5. Do I still get a W-2 form if I worked for only part of the year?

Yes, even if you worked for part of the year, you should still receive a W-2 form if you earned wages that are reportable to the IRS. This includes wages from temporary or seasonal employment. Your employer will provide a W-2 reflecting the income earned and taxes withheld during your employment period.

6. What if I worked for multiple employers during the year? Will I receive multiple W-2 forms?

If you worked for multiple employers within a year, you will receive a separate W-2 form from each employer. Each form will detail the wages earned and taxes withheld from that specific employment. Be sure to keep track of all W-2s to accurately report your income on your tax return.

7. How do I file my taxes if I haven’t received my W-2 by the tax deadline?

If you haven’t received your W-2 by the tax deadline, you should file for an extension, estimate your income using your last pay stub, and use that information to complete your tax return. It’s important to provide the IRS with accurate estimates and then amend your return if necessary once you receive your W-2. Alternatively, you can contact the IRS for guidance on how to proceed.