W2 Tax Form 2025 – Many individuals are eager to understand when they can expect their W2 Forms to arrive, as these documents are imperative for your tax filing process. Typically, employers are required to send these forms to their employees by January 31st each year. This timeline is important because receiving your W2 on time ensures you can file your taxes promptly and avoid any potential penalties related to late submissions. By knowing the schedule for W2 distribution, you can better manage your financial planning during tax season.

Key Takeaways:

- Deadline for Employers: Employers are required to send out W-2 forms by January 31 of each year.

- Electronic Delivery: Many employers offer an option for electronic delivery of W-2 forms, which can be received earlier than paper versions.

- Tax Filing: W-2 forms are crucial for filing income taxes, as they provide necessary wage and tax information.

- Follow-Up: If you haven’t received your W-2 by mid-February, it’s advisable to contact your employer for assistance.

- Form Availability: W-2 forms are also available through payroll service providers and online employee portals if your employer uses such services.

- Multiple Employers: If you worked for multiple employers during the year, you will need to collect a W-2 from each one for accurate tax reporting.

- State Variations: Some states may have different rules or deadlines concerning the distribution of W-2 forms, so it’s good to be aware of local regulations.

The Importance of W-2 Forms

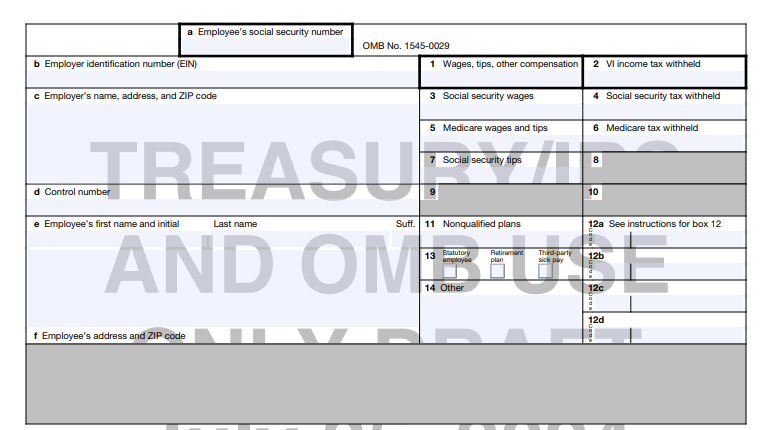

A W-2 form is an crucial document for anyone who earns a salary or wage during the year. As an employee, you rely on this form to accurately report your income, taxes withheld, and other vital information needed for your tax return. Understanding its significance can help you efficiently navigate your tax obligations and ensure you receive any potential refunds or credits.

Definition and Purpose

Around the end of the tax year, employers are required to provide W-2 forms to their employees. This form outlines your total earnings, income tax withheld, and Social Security contributions. It serves as an official record for both you and the IRS, ensuring accurate and timely tax filing.

Impact on Tax Filing

To file your taxes correctly and efficiently, you need the information included in your W-2 form. This document not only summarizes your annual earnings but also informs you of any taxes that have already been deducted. Without this crucial information, your tax return may be inaccurate, which could lead to unwanted delays or penalties.

Another important aspect of the W-2 form is its impact on your tax return. If you fail to include the information on your W-2, you risk audit by the IRS, resulting in possible fines or a delayed refund. On the upside, having a correctly filled W-2 form can facilitate a smoother tax filing process and potentially help you receive a larger refund if you qualify for various credits. Always ensure you review your W-2 for accuracy to avoid any unnecessary complications in your finances.

W-2 Form Distribution Timeline

While the specific timeline for W-2 form distribution can vary slightly each year, employers are generally required to send these forms to employees by January 31st. This ensures that you have your W-2 in hand for filing your taxes on time. It’s important to be proactive and check with your employer if you haven’t received your form by the expected date, as timely distribution is vital for fulfilling your tax obligations.

Employer Responsibilities

Behind each W-2 form distribution, employers are obligated to ensure that the information is accurate and timely. They must compile the necessary data throughout the year and prepare your W-2 by the deadline. Additionally, employers are responsible for delivering these forms to both you and the IRS, ensuring compliance with federal regulations.

Deadlines for Sending Out Forms

One of the key deadlines for sending out W-2 forms is January 31st. Employers must provide them to employees and file copies with the IRS by this date to avoid penalties. Failure to meet this deadline can lead to significant fines for employers, which may affect their willingness to comply, so stay informed about your employer’s practices.

Forms must be issued to employees by January 31st each year. If your employer fails to provide you with your W-2 on time, they could face penalties from the IRS, which might not only be a financial burden but can result in delays in your tax filing. Ensure you keep track of your employer’s compliance and report any issues promptly. Missing or incorrect forms can lead to further complications in your filing process, so it’s vital to verify that all information is correct as soon as you receive your W-2.

Electronic vs. Paper W-2 Forms

Unlike paper W-2 forms, electronic W-2 forms offer a more efficient way to access your tax information. Many employers now provide you with the option to receive your W-2 electronically, which can save on printing and mailing costs. Additionally, electronic forms can be easily stored and retrieved, enhancing your record-keeping practices.

Benefits of Electronic Forms

Along with convenience, electronic W-2 forms provide quicker access to your tax documents, allowing you to file your taxes sooner. You can retrieve your forms anytime, anywhere, cutting down on the risk of losing important paperwork. Plus, it promotes an eco-friendly approach by reducing paper waste.

Submission Methods

Forms can be submitted electronically, by mail, or in-person, depending on your employer’s preferred methods. When submitting electronically, it’s important to ensure that your information is securely transmitted and that you use reliable digital platforms. For paper submissions, make sure your W-2 is mailed securely and, if possible, tracked to prevent it from getting lost.

Methods for submitting your W-2 forms vary by employer and can significantly impact your filing process. Electronic submissions are often the fastest and most secure option, reducing the risk of identity theft compared to physical mail. However, if you opt for paper forms, ensure to send them via certified mail or with a tracking service to avoid potential loss. Always check your employer’s submission guidelines to ensure you comply with their requirements.

What to Do If You Haven’t Received Your W-2

Now that tax season is underway, it’s important to address the issue of not receiving your W-2. If you’re in this situation, don’t panic. There are steps you can take to resolve it effectively and ensure you file your taxes on time. Start by investigating the reason behind the delay; it may be a simple oversight or miscommunication that can be easily rectified.

Contacting Your Employer

Above all, the first course of action is to reach out to your employer or the HR department. They are typically responsible for issuing W-2 forms, and by contacting them, you may find out if there was an error or if your form has yet to be mailed out. Make sure to have your details ready, including your employment dates, to expedite the process.

Filing Without a W-2

The next step, if you still have not received your W-2, is to consider filing your taxes without it. You can use Form 4852, which acts as a substitute for your W-2. This form requires you to estimate your income and withholding amounts based on your pay stubs or any other documentation you have.

Considering the possibility of filing without a W-2, it’s important to be accurate when estimating your income. Use your most recent pay stubs to total your earnings and the taxes withheld. If the IRS finds discrepancies later, you might have to pay additional taxes and possible penalties. Ensure that you provide as much detail as you can to avoid issues down the line, making it imperative to keep copies of any documents you submit with your tax return.

Common Errors on W-2 Forms

Your W-2 forms are necessary for accurate tax filing, but they can contain errors that may lead to complications. These mistakes can affect your tax return and even delay your refund. Identifying these problems early will help ensure a smoother filing process.

Types of Errors

Your W-2 forms might include various types of errors, such as:

- Incorrect Social Security Number

- Misspelled Names

- Wrong Wage Amounts

- Incorrect Employer Identification Number

- Improper Tax Withholding Information

Perceiving these mistakes early is necessary to rectify any issues before filing.

| Error Type | Impact |

| Incorrect Social Security Number | May lead to tax rejection |

| Misspelled Names | Can cause delays |

| Wrong Wage Amounts | Incorrect tax liability |

| Incorrect Employer Identification Number | Complications with IRS |

| Improper Tax Withholding Information | Unexpected tax bills |

How to Address Mistakes

Behind every W-2 error is a potential solution. If you identify any inaccuracies on your W-2 form, promptly contact your employer for a corrected version, known as the W-2c. This is necessary for ensuring that the information you report on your tax return matches what the IRS has on file, helping to prevent any issues.

This process is particularly important as inaccuracies can lead to an audit or even an unexpected tax bill. If you find an error, reach out to your employer as soon as possible. They are required to provide you with a corrected form, so your tax return aligns accurately. Maintaining accurate records is imperative for peace of mind, allowing you to file your income taxes smoothly and efficiently.

Conclusion

Taking this into account, you can expect your W-2 forms to be sent out by January 31st of each year. Employers are obligated to provide these forms to you as well as the IRS by this deadline. If you do not receive your W-2 in the expected timeframe, it’s important for you to contact your employer to resolve any issues promptly. This ensures you have the necessary documentation to file your taxes accurately and on time.

FAQ

1. When can I expect my W-2 forms to be sent out?

W-2 forms are generally sent out by employers by January 31 of each year, reflecting the income earned and taxes withheld from the previous year.

2. Who is responsible for sending out W-2 forms?

Employers are responsible for preparing and distributing W-2 forms to their employees. This includes both physical mail delivery and electronic distribution, if the employee has opted to receive their forms electronically.

3. What should I do if I haven’t received my W-2 form by mid-February?

If you have not received your W-2 by mid-February, it is advisable to contact your employer’s payroll or human resources department. They can provide information on the status of your W-2 and confirm that it has been sent to the correct address.

4. Can I access my W-2 form online?

A: Many employers offer electronic access to W-2 forms through employee portals. If you have access to such a portal, you may be able to download or print your W-2 directly from there.

5. What should I do if my W-2 form has incorrect information?

If you notice incorrect information on your W-2 form, such as your name or social security number, you should contact your employer as soon as possible. They will be able to issue a corrected W-2, known as a W-2c, to resolve any discrepancies.

6. Are there any penalties for missing the W-2 deadline?

Employers may face penalties for failing to provide W-2 forms by the January 31 deadline. If an employer is late in sending out W-2 forms, it could lead to fines imposed by the IRS, and employees may encounter delays in filing their tax returns.

7. What if I can’t find my W-2 form when it’s time to file my taxes?

If you cannot locate your W-2 form by the time you are ready to file your taxes, you should first contact your employer to request a duplicate. Alternatively, you can use Form 4852, which is a substitute for the W-2, to report your income and withholding if necessary.