W2 Tax Form 2025 – W2 forms are crucial for tax filing, and losing one can lead to delays and complications in your submissions. If you’re wondering how to retrieve a lost W2-form, you’ll be glad to know that the process is straightforward. You should start by contacting your employer or the payroll department to request a replacement. If that doesn’t work, the IRS can help you obtain the information you need. Act quickly to ensure your tax filings proceed without complications and to avoid potential penalties.

Key Takeaways:

- Contact your employer: The first step to obtaining a lost W-2 form is to reach out to your employer’s HR or payroll department.

- Use the IRS Form 4506-T: If you are unable to get your W-2 from your employer, you can request a transcript of your W-2 using the IRS Form 4506-T.

- Check your email and online portals: Many employers now provide electronic copies of W-2 forms, so double-check your email and payroll service portals.

- File your tax return: If your W-2 is still unavailable by the tax filing deadline, file your tax return using Form 4852 as a substitute.

- Keep records: Document all communications with your employer regarding your lost W-2, as this may be necessary if you need to appeal to the IRS.

- Check for deadlines: Be aware that there are deadlines for filing your tax return and for employers to issue W-2 forms, so act promptly.

- Contact the IRS: If you still cannot obtain your W-2 after trying these steps, consider reaching out to the IRS for further assistance.

Understanding the Importance of the W-2 Form

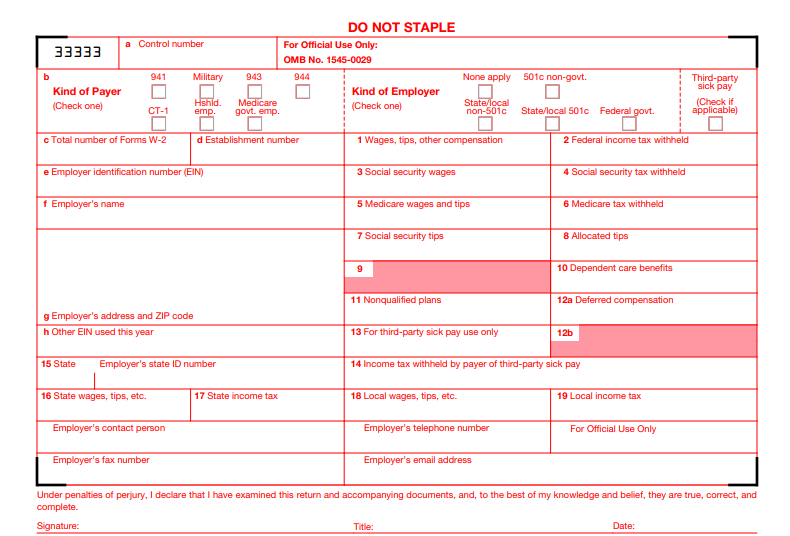

Before filing your taxes, it’s important to grasp why the W-2 form is significant. The W-2 form summarizes your annual earnings, the taxes withheld by your employer, and the Social Security and Medicare contributions made on your behalf. This document plays a vital role in ensuring that you accurately report your income and comply with federal and state tax requirements.

What is a W-2 Form?

Among the various tax documents you will encounter, the W-2 form is one of the most important. It is issued by your employer and details your earnings for the year, along with the taxes that have been withheld from your paycheck. This information is necessary for you to accurately report your income when filing your tax return.

Why is it Important for Tax Filing?

Between the various forms needed when filing your taxes, the W-2 is particularly significant. It provides the necessary information to assess your tax liability and determine any potential refund or payment owed. If you lack this document, you may face delays in your filing process as you try to reconstruct your income and tax information.

But without the W-2, you put yourself at risk of inaccurate reporting, which can result in penalties or even an audit. This form is critical for ensuring you declare all your income, and it helps identify any overpaid taxes for potential refunds. If you fail to file or report incorrectly, you could end up owing extra taxes, incurring interest, and facing legal issues. Therefore, having it on hand is more than just a matter of convenience; it is important for your financial well-being.

Common Reasons for Losing a W-2 Form

Even the most organized individuals can misplace important documents like W-2 forms. Whether it’s due to a hectic schedule, relocation, or simply forgetting where they were stored, losing your W-2 can happen to anyone. Understanding the common reasons behind this issue can help you take proactive steps to keep track of your tax documents.

Misplacement

Form storage can be a challenge, and many people unintentionally misplace their W-2s among other tax paperwork. It’s not uncommon to misfile important documents or lose them during a move or cleaning, which can lead to stress during tax season when you need them most.

Employer Changes

For individuals who have switched jobs or experienced changes with their employer, the chances of losing a W-2 increase significantly. If you move, change your name, or transition between multiple jobs within a tax year, your W-2 may be sent to an old address or potentially lost in the shuffle.

Also, if your former employer is out of business or has been acquired by another company, obtaining your W-2 can become problematic. In these situations, it’s important to reach out promptly to your past employer for assistance and ensure they have your correct details. If they cannot provide the form, you may need to file a substitute form (Form 4852) with the IRS, which can complicate your filing process. Your diligence in keeping track of employer-related information can help you avoid unnecessary delays during tax season.

Steps to Obtain a Replacement W-2 Form

Keep in mind that obtaining a replacement W-2 form is a straightforward process. You will typically need to take the necessary steps to contact your employer, and if that doesn’t yield results, you can leverage IRS resources to help you recover your lost form efficiently.

Contacting Your Employer

Across all industries, your employer is your primary resource for securing a replacement W-2 form. Reach out to your payroll or HR department to request a new copy. Be prepared to provide personal information to verify your identity and ensure they can assist you effectively.

Using the IRS Resources

After you’ve contacted your employer, if you’re still unable to obtain your W-2, the IRS can assist you. You can file Form 4852, which serves as a substitute for your W-2, provided you report your estimated wages. Be sure to gather any available documents, such as pay stubs, to facilitate the process.

Consequently, using IRS resources can help you avoid delays in filing your tax return. If you still haven’t received your W-2 by mid-February, contact the IRS directly at 1-800-829-1040 for guidance. They can help confirm your employer’s details and may even send you a Form 4852 for you to complete. Always keep diligent records, as this will aid in expediting the replacement process and safeguarding your tax filing.

Filing Your Taxes Without a W-2 Form

Not having your W-2 form shouldn’t stop you from filing your taxes. If you’ve misplaced it, you can still report your income and fulfill your tax obligations. Keep in mind that you must accurately estimate your earnings and any withholdings to avoid complications down the line. While it’s ideal to have the official document, alternatives exist to help you complete your tax return on time.

Alternatives for Reporting Income

On occasion, you might need to rely on other options for reporting your income if you cannot obtain your W-2. You can use pay stubs, bank statements, or any financial records that reflect your earnings during the tax year to help you accurately report your income.

Filing Form 4852

With your W-2 lost, you can file Form 4852, which acts as a substitute for your missing document. This form allows you to report your wages and tax withheld while providing the IRS with the necessary information to process your return.

Reporting income using Form 4852 requires that you provide as much accurate information as possible about your wages and withholdings. You must also explain why you’re using this form, such as the loss of your W-2. Be cautious, as filing with incorrect estimates can lead to delays or potential penalties. Ensure you fill out Form 4852 correctly to avoid issues with the IRS, and consider keeping thorough records of your attempts to obtain the original W-2 to support your case if needed.

Deadlines and Timelines

All tax forms, including your W-2, have specific deadlines to ensure timely filing of your income tax return. Generally, your employer must provide your W-2 by January 31st of each year. If you do not receive it within this timeframe, you should contact your employer immediately to avoid delays in your filing process.

Key Dates to Remember

Along with the January 31st deadline for W-2 distribution, it’s crucial to keep track of the tax filing deadline, which is typically April 15th. If you need an extension, you must file Form 4868 by April 15th to receive additional time to submit your tax return.

Possible Penalties for Delay

An important consideration is that failing to meet these deadlines can lead to significant consequences, including penalties and interest on unpaid taxes. If you miss the filing deadline, you may incur a late filing penalty, which can be as high as 5% of your unpaid taxes for each month of delay, up to a maximum of 25%. Being proactive about obtaining your W-2 can help you avoid these costly repercussions.

Further, it’s crucial to understand that if you fail to file your taxes altogether, the penalties become even more severe. The IRS may impose a failure-to-file penalty, starting at 5% of your unpaid taxes per month. This can accumulate quickly if you delay, so taking action to obtain your W-2 and file your taxes timely can save you from these financial setbacks.

Preventative Measures for Future Tax Seasons

Once again, being proactive can save you from the headache of losing your W2 form in the future. By implementing some simple strategies, you can simplify your tax season and ensure that your documents are easily accessible. From organizing your paperwork to creating backups, these steps can help streamline the process and reduce the stress associated with tax filing.

Organizing Important Documents

Before each tax season, take the time to organize your important documents. Create a designated folder or binder for all tax-related paperwork, including W2s, 1099s, and any other relevant forms. Label sections clearly to make locating documents quick and easy, and consider using a checklist to ensure you have everything you need when it’s time to file your taxes.

Digital Copies and Backups

Any effective strategy for managing your tax documents includes creating digital copies and backups. Storing your important tax forms on a secure cloud service or an external drive ensures that you have immediate access in case of loss or damage to physical copies.

Documents can easily be misplaced or damaged, making it imperative for you to have digital copies of your tax paperwork. Scan your W2 forms and other critical documents and save them in a secure, organized manner. Utilize strong passwords to protect your files, ensuring that your sensitive information remains safe. Additionally, consider setting reminders to back up your files regularly, as this can prevent future losses and provide you with a positive safety net when tax season arrives.

Conclusion

From above, you can see that obtaining a lost W-2 form is a straightforward process. Start by contacting your employer directly for a reissued copy, or check your online payroll account if available. If these options don’t work, reach out to the IRS for assistance. By following these steps, you can efficiently track down your lost W-2 and ensure your tax reporting goes smoothly.

FAQ

1. What should I do if I lost my W-2 form?

If you have lost your W-2 form, the first step is to contact your employer’s payroll or human resources department. They can provide you with a duplicate copy of the W-2 form. Make sure to provide them with your personal information to verify your identity.

2. Can I get a copy of my W-2 from the IRS?

A: Yes, you can request a copy of your W-2 from the IRS. While they do not issue copies of W-2 forms, they can provide a transcript of your earnings. You can request this transcript by filling out Form 4506-T and submitting it to the IRS.

3. How can I request a duplicate W-2 from my employer?

To request a duplicate W-2 form from your employer, you can either call or email the payroll or HR department. Provide your full name, Social Security number, and the dates of employment to assist them in locating your information. It’s best to do this as soon as possible to ensure you receive the form before tax season deadlines.

4. What is the deadline for employers to send out W-2 forms?

A: Employers must typically send out W-2 forms to their employees by January 31st of each year. If you haven’t received your W-2 by this date, it is advisable to reach out to your employer for a follow-up.

5. What if I can’t reach my employer for a lost W-2?

If you can’t reach your employer, you have the option to contact the IRS directly. They can provide guidance on how to proceed, including how to file a tax return without your W-2 and what alternative documentation you may use.

6. What information do I need to provide to request a new W-2?

When requesting a new W-2 form, you should provide your full name, Social Security number, current address, and details about your employment, such as your job title and the dates of employment. This information helps your employer quickly locate your records.

7. Can I file my taxes without my W-2?

Yes, you can file your taxes without your W-2, but you’ll need to estimate your earnings using other documents like pay stubs or previous tax filings. Be prepared to explain this to the IRS if necessary, and you may need to file Form 4852, which serves as a substitute for the W-2.