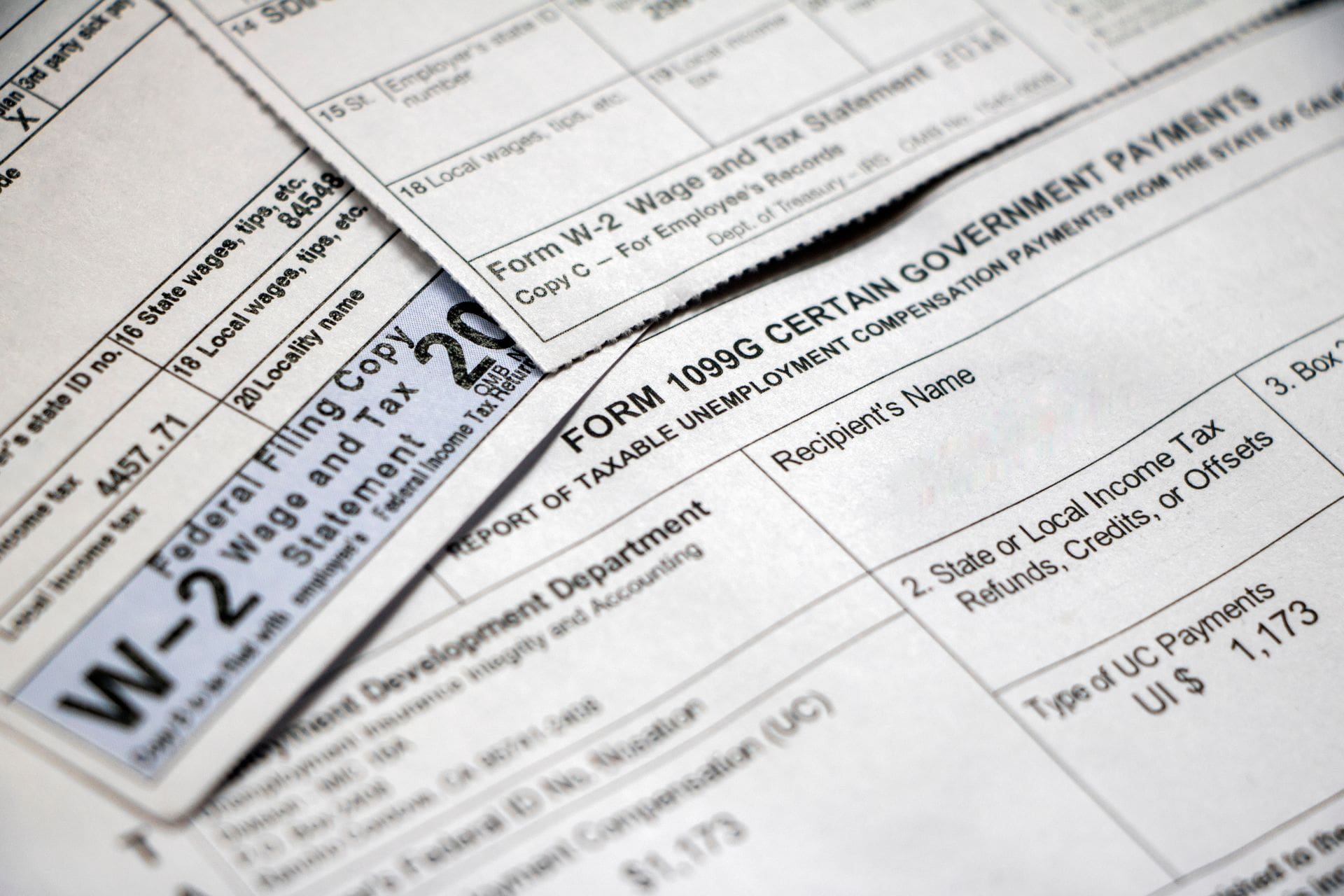

W2 Tax Form 2025 – With the tax season approaching, filing your W-2 form accurately is imperative to avoid issues with the IRS. This form, provided by your employer, reports your annual wages and taxes withheld. To ensure compliance, you should double-check your information, submit it on time, and keep copies for your records. By following the steps outlined in this guide, you can simplify the process and minimize the risk of penalties. Let’s explore how to effectively file your W-2 form and stay on top of your tax responsibilities.

Key Takeaways:

- Understand the Purpose: The W2 form reports annual wages and taxes withheld for employees, which is necessary for tax filing.

- Gather Necessary Information: Collect employee data, including Social Security numbers, wages, tips, and deductions for accurate reporting.

- Choose the Correct Form: Use Form W-2 for employees and Form W-3 for summarizing all W-2s submitted to the IRS.

- File on Time: Ensure W-2 forms are submitted to the IRS and delivered to employees by the January 31 deadline each year.

- Use E-Services: Consider filing electronically for ease and quick processing through IRS e-file systems.

- Review for Accuracy: Double-check all entries for accuracy to avoid potential penalties or delays in processing.

- Keep Records: Maintain copies of filed W-2 forms and related documents for at least four years for reference and audits.

Understanding the W-2 Form

A W-2 form is a crucial tax document that employers provide to their employees at the end of each year. It details the wages earned and the taxes withheld, helping you accurately report your income to the IRS. This form is necessary for filing your tax return, as it summarizes your earnings and tax contributions for the year.

What is a W-2 Form?

Above all, a W-2 form, officially known as the Wage and Tax Statement, is issued by employers to their employees. It contains vital information such as your total earnings, Social Security wages, Medicare wages, and taxes withheld over the year, which you will need for tax preparation.

Why is it important?

Across the board, the W-2 form plays a significant role in your financial responsibilities. It ensures that you receive proper credit for the taxes you’ve paid, and it’s necessary for accurately filing your tax return. Without this document, you may risk errors in your tax filings, which could lead to delayed refunds or unwanted penalties.

Important aspects of the W-2 form include its role in tax compliance and ensuring you pay the right amount of taxes. By providing a detailed record of your earnings and withholdings, the W-2 helps you avoid potential audits and penalties by the IRS. Failing to file or misreporting your income can haveserious repercussions, such as owing back taxes or incurring fees. Obtaining your W-2 on time allows you to file your return promptly, increasing the chances of receiving your refund faster, which can be apositive aspect of tax season.

Who Needs to File a W-2 Form?

Any employer that pays you $600 or more in wages, salaries, or tips during the tax year is required to file a W-2 form. Additionally, W-2 forms must be issued for employees who receive certain types of benefits. If you’re a worker in the United States and you receive compensation from your employer, they need to provide you with this important document, which is vital for accurately reporting your income when you file your taxes.

Employers’ Responsibilities

About filing W-2 forms, the employer is responsible for providing accurate wage and tax information to both you and the IRS. They must prepare and file the W-2 form by the deadline, which is typically January 31 of the following year. Your employer must ensure that all information is correct and up-to-date, including your Social Security number, name, and the amounts withheld for taxes. Failure to comply with these requirements can lead to penalties.

Employees’ Responsibilities

File your own taxes accurately by using the information provided on your W-2 form. It is your responsibility to ensure that the details match your financial records and to report any discrepancies to your employer. You should also keep your W-2 form for your records, as it is vital during tax season.

Further, you must ensure that you provide your employer with the correct personal information so that they can accurately complete your W-2. If you discover any errors on your W-2, such as incorrect wages or unanswered tax withholdings, it’s important to notify your employer immediately. Ignoring such discrepancies can lead to issues during tax filing and potentially incur penalties from the IRS. Always use the W-2 to report your income when filing your taxes to avoid complications.

How to Obtain the W-2 Form

Despite being an important tax document, obtaining your W-2 form can be straightforward if you know where to look. Typically, you will receive this form from your employer, detailing your earnings and tax withholdings for the previous year. If you haven’t received it, there are several methods to obtain a copy.

From Your Employer

Against common belief, your employer is required to provide you with your W-2 form by January 31st of the following year. If you haven’t received it, don’t hesitate to contact your HR department or payroll administrator. They can assist you in ensuring that you have all the necessary documentation for your tax filing.

Downloading from IRS Website

At times, you may need to obtain a copy of your W-2 directly from the IRS. Fortunately, the IRS provides a means to download tax forms, but it’s important to note that you won’t find your W-2 there unless you’ve had it issued through the IRS itself. Instead, you will have to use the Form 4506-T to request a transcript of your wage and income information.

In addition, if you’re looking to download W-2 forms from the IRS website, be prepared to follow specific procedures. The IRS provides access to a Wage and Income Transcript through the IRS Get Transcript online tool that displays data from your previous tax filings. However, this option only shows brief income summaries, so you may need to request a more detailed documentation by completing and sending in Form 4506-T. Keep in mind that processing time may vary, so plan ahead if you require this information.

Completing the W-2 Form

Now that you have the necessary documents, it’s time to start completing your W-2 form. This form is crucial for reporting your wages and the taxes withheld from your paycheck. Ensure you fill out all relevant sections accurately to avoid complications when filing your taxes.

Required Information

Completing the W-2 requires specific information, such as your employer’s identification number, your earnings, and the amounts of Social Security and Medicare taxes withheld. Be sure to gather all necessary documentation, including pay stubs, to provide accurate figures.

Common Mistakes to Avoid

For a smooth tax filing experience, avoid common mistakes that can cause delays or issues with the IRS. Make sure to double-check names, Social Security numbers, and ensure you are reporting accurate amounts.

Even the smallest errors can lead to significant issues with your tax return. Inaccurate Social Security numbers can cause a mismatch with the IRS, leading to delays in processing your return. Misreporting your earnings or taxes withheld may result in penalties or additional taxes owed. Always take the time to review your entries meticulously to ensure the accuracy of your W-2 form. Proper attention now can save you a lot of headaches later!

Filing Your W-2 Form

To file your W-2 form, ensure you have accurate information about your earnings and withheld taxes. Start by gathering your W-2 forms from your employer, which you should receive by the end of January. You can file your W-2 electronically or by mail, depending on your preference and circumstances. Make sure to include any necessary supporting documents to avoid delays.

Where to Submit

Besides filing online, you can submit your W-2 form by mailing it to the Social Security Administration. Ensure you send it to the correct address listed for your state, and consider using a tracked mailing service to confirm delivery.

Deadlines for Filing

Filing your W-2 form accurately and on time is imperative. The standard deadline for employers to send W-2 forms to you is January 31. If you’re self-filing, your deadline is typically April 15. Your tax return must be filed by this date, so you’ll need to have all forms in hand to avoid penalties and interest on late submissions.

Plus, filing late can lead to unnecessary complications for your tax filing process. If you miss the April deadline, you may face financial penalties or interest on taxes owed. It’s vital to be proactive; if you have not received your W-2 by early February, contact your employer to resolve any issues. Staying informed and timely in your filings will help you maintain your financial health and compliance.

Common FAQs about W-2 Forms

All employees and employers have questions about W-2 forms, especially regarding deadlines, filing methods, and penalties for mistakes. This section addresses common concerns to help you navigate the process efficiently and ensure compliance with IRS regulations.

What if you don’t receive your W-2?

Dont worry if you haven’t received your W-2 by mid-February. First, check with your employer to confirm it was sent. If they claim it was, ensure that your mailing address is correct. If you still don’t receive it, you can contact the IRS for further assistance and potentially file your taxes using Form 4852, a substitute for your W-2.

Can you e-file a W-2?

By IRS regulations, employers can e-file W-2 forms. This is a popular method as it simplifies submitting tax forms electronically, allowing for faster processing times and reducing the chances of errors.

efile options for W-2 forms include using tax software or the IRS’s e-file system. Many tax preparation services allow you to directly input your W-2 information and submit it to the IRS electronically. This method is especially beneficial because it reduces processing time, minimizes the risk of data entry errors, and helps you track your submission status. Ensure your information is accurate before submitting, as mistakes may lead to delays in your tax refund or possible penalties.

To wrap up

With these considerations, filing your W2 form can be streamlined and efficient. Ensure you gather all your necessary documents, such as your employee details and income information, before starting the process. You can file online or by mail, whichever suits your preference, while paying attention to deadlines to avoid penalties. Always double-check your information for accuracy, as this will save you time and potential issues later on. By following these steps diligently, you’ll complete your filing without unnecessary stress.