W2 Tax Form 2025 – Just when you think tax season can’t get any more overwhelming, you realize you need your W-2 form from the IRS. This necessary document provides a summary of your annual earnings and taxes withheld, making it vital for your tax filing accuracy. If you haven’t received it from your employer, don’t panic. You can request a duplicate directly from the IRS. Follow our step-by-step guide on how to obtain your W-2 form promptly so you can file your taxes smoothly and avoid any potential penalties or delays.

Key Takeaways:

- Contact Your Employer: The first step is to request your W2 form directly from your employer, as they’re required to provide it by January 31st of each year.

- Use IRS Online Tools: You can utilize the IRS ‘Get Transcript’ tool online to access your W2 information if it has been reported to the IRS.

- File a Form 4506-T: If you cannot get your W2 from your employer, consider filing Form 4506-T to request a transcript that includes W2 details.

- Check the IRS Mail: If your employer has filed your W2 with the IRS, you may receive a copy in the mail by early February.

- Seek Professional Assistance: If you’re having difficulty obtaining your W2, consult a tax professional for guidance on the next steps.

- Keep Records: Maintain a record of your earnings and withholding for reference, which can assist in completing your tax return when W2 forms are unavailable.

- File Your Taxes on Time: If you cannot obtain your W2 in time, file your taxes using your estimated earnings and file Form 4852 as a substitute.

Understand the W-2 Form

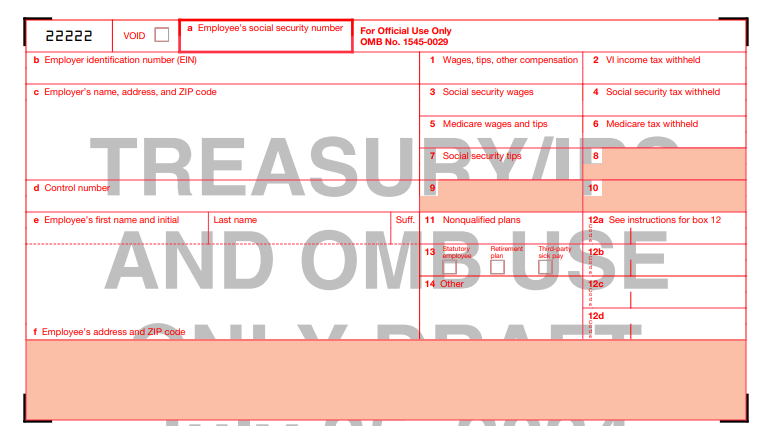

While navigating your tax obligations, it’s necessary to grasp the significance of the W-2 form. This document summarizes your annual earnings and the taxes withheld from your paycheck, helping you accurately report your income to the IRS and understand your financial situation better.

What is a W-2 Form?

Along with your income details, a W-2 form provides critical information about your employer, including their identification number and the total wages you earned during the tax year. This form is necessary for employees who receive wages, salaries, or tips and helps you prepare your federal and state tax returns.

Importance of the W-2 Form

With your W-2 form, you can confirm that the correct amount of taxes has been withheld, allowing you to avoid any unexpected tax liabilities. This form also plays a role in determining your eligibility for credits and deductions that can ultimately reduce your tax burden.

Considering the role of the W-2 form, you must ensure that the information is accurate and complete. Verify the reported wages and withheld taxes to prevent potential issues with the IRS. In case of discrepancies, quickly address them with your employer. Having an accurate W-2 helps you maintain a positive relationship with the IRS and can result in receiving any refund you may be entitled to, ensuring you stay on track with your financial goals.

Who Needs a W-2?

There’s a specific group of individuals who need a W-2 form for tax purposes. If you are an employee working for an employer, you will receive this form detailing your annual wages and the taxes withheld from your paycheck. It’s important to obtain this document, as it is imperative for accurately filing your income tax return.

Employees vs. Independent Contractors

One of the key distinctions in the workforce is between employees and independent contractors. Employees receive a W-2 form, as their employer directly withholds taxes from their paychecks. In contrast, independent contractors are typically not provided a W-2; instead, they receive a 1099 form to report their income and handle their own tax obligations.

Filing Requirements

An understanding of filing requirements is vital when managing your taxes. If you are an employee and receive a W-2, you must include this form in your tax return. The IRS uses your W-2 to verify your income and the taxes you’ve paid throughout the year.

A W-2 form not only reports your total earnings but also shows the federal, state, and local tax withholdings. If you fail to include your W-2 when filing your taxes, you may face delays in processing your return or potential penalties. It is imperative to ensure your W-2 accurately reflects your information, as discrepancies can lead to further IRS scrutiny. Always keep an eye out for your W-2 from your employer by January 31st each year to stay compliant.

Obtaining Your W-2 from Your Employer

To obtain your W-2 form, you should first contact your employer, as they are responsible for providing this vital document. Typically, your employer will issue W-2s by the end of January, so it’s important to check in if you haven’t received yours by then. Your company’s payroll department can guide you on the specific process or confirm whether your form has been sent out.

Requesting Your W-2

Above all, if you have not received your W-2 by mid-February, it’s important to reach out to your employer to request a copy. Be sure to include your identifying details, such as your full name, Social Security number, and address, to streamline the process.

Employer Deadlines

Your employer is required to send out W-2 forms to employees by January 31st each year. This deadline ensures that you have adequate time to prepare your tax return. If your employer fails to meet this deadline, they may face penalties from the IRS for late filing.

Plus, ensuring your employer adheres to the January 31st deadline is important for your tax preparation. If you don’t receive your W-2 in time, you might face delays in filing your return, which could impact your potential refund. If your employer repeatedly fails to provide W-2s on time, consider contacting the IRS directly to report the issue, as they can offer guidance on how to resolve this matter.

Requesting a Duplicate W-2

Your first step in obtaining a duplicate W-2 involves reaching out to your employer. Employers are typically required to provide you with a copy of your W-2 upon request. If your original document was lost or not received, contact your employer’s payroll or human resources department to ask for a replacement. They may issue a new W-2 directly or send a copy electronically if available.

Contacting the Employer

Against common practice, some employers may delay providing duplicates or may not keep records for prior years. Be sure to act quickly and clearly state why you need the duplicate, which can expedite the process.

Using IRS Form 4506-T

After exhausting options with your employer, you can request a copy of your W-2 through IRS Form 4506-T. This form allows you to obtain a transcript of your W-2 from the IRS directly, ensuring you receive the information you need straight from the source.

For instance, when you complete Form 4506-T, make sure to specify that you want a transcript of your W-2. The IRS typically processes this request within a few weeks. Submit it by mail or fax, and be sure to include your Social Security number, the employer’s name, and the tax year for which you need the W-2. This method is particularly useful if you have not been able to get a satisfactory response from your employer.

Getting Your W-2 from the IRS

All taxpayers may need to contact the IRS if they cannot obtain their W-2 form from their employer. The IRS can provide assistance in getting a duplicate W-2 if your employer fails to send it or if it’s lost in the mail. It’s important to act quickly to ensure your tax return is filed on time and accurately.

How to Contact the IRS

For immediate assistance, you can reach the IRS by calling their toll-free number at 1-800-829-1040. Be prepared for potential wait times as lines can be busy. Be sure to have your personal information and tax details ready to expedite the process.

Required Information

At the time of your call, you will need to provide specific details to the IRS representative.

Contact the IRS with the following required information: your name, Social Security number, address, and the tax year for which you’re requesting the W-2. Additionally, if available, include your employer’s name and address. Providing complete and accurate information is necessary to expedite the process, as missing details could delay your request. The IRS may take a few weeks to process your application, so it’s best to act swiftly.

Using Online Resources

Not all methods require you to wait for your employer to send your W2 Form. There are several online resources available that can help you obtain your W2 quickly and efficiently, allowing you to stay on top of your tax obligations.

IRS Online Tools

Online tools provided by the IRS can simplify the process of obtaining your W2 Form. By visiting the IRS website, you can access their free services, which include options to check the status of your W2 and to request copies if you’ve misplaced yours.

Third-Party Services

Using third-party services can also be a convenient way to help you get a copy of your W2. These services may charge a fee, but they often provide additional support and faster access to your forms.

And while third-party services can indeed expedite your W2 retrieval process, it’s important to exercise caution. Ensure that you choose only reputable services to avoid potential scams and identity theft. Before providing any personal information, verify their credentials and read reviews. Weigh the cost against the benefit, as some services may utilize aggressive marketing tactics or hidden fees. Always prioritize your personal data security when engaging with these platforms.

Final Words

Hence, obtaining your W2 form from the IRS is streamlined by completing Form 4506-T to request a copy of your tax return, or by contacting your employer directly if the form is not readily available. You can also access your W2 through your online tax account with the IRS or use the IRS’s Get Transcript service. By following these steps, you’ll ensure that you have all necessary documentation at hand for your tax filing needs.

FAQ

1. What is a W-2 Form?

The W-2 Form, also known as the Wage and Tax Statement, is a document that employers are required to provide to their employees. It outlines the employee’s total earnings, federal and state taxes withheld, Social Security and Medicare contributions for the year.

2. Who needs a W-2 Form?

Employees who worked for an employer during the calendar year and received wages are entitled to a W-2 Form. If you earned money as an independent contractor or freelancer, you would typically receive a 1099 Form instead.

3. How can I get my W-2 Form from my employer?

The simplest way to obtain your W-2 Form is to ask your employer directly. Many employers provide electronic copies via payroll services or through their HR portal. If you do not receive your W-2 by January 31, you should contact your employer’s HR or payroll department.

4. What can I do if my employer doesn’t provide my W-2?

If your employer does not provide your W-2 Form, you should first reach out to them and request it. If you still do not receive it by mid-February, you can contact the IRS at 1-800-829-1040. They will ask for details about your employment and can send a Form 4852, which acts as a substitute for your W-2.

5. Can I get a copy of my W-2 from the IRS?

Yes, if you are unable to obtain your W-2 from your employer, you can request a copy from the IRS. However, this may take longer than obtaining it directly from your employer. The IRS provides copies of W-2 forms upon request, which can be done using Form 4506-T. Be aware that there may be a waiting period.

6. What if I’ve lost my W-2 Form?

If you have lost your W-2 Form, you should first contact your employer to request a duplicate copy. If you cannot reach your employer or they are unable to provide a copy, you can use Form 4852, which can be submitted with your tax return as a substitute for your missing W-2.

7. Is there a deadline for requesting a W-2 Form from my employer?

While there is no specific deadline for requesting a W-2, it is advisable to do so as soon as possible after the tax year ends. Employers are required to send out W-2 Forms by January 31 of the following year for the previous year’s earnings. If you have not received yours by mid-February, you should definitely follow up with your employer.