W2 Tax Form 2025 – You may find yourself asking, where can you access your W2 form online? This important tax document, which summarizes your annual earnings and withholdings, is imperative for filing your income taxes accurately. Fortunately, acquiring your W2 form online is a straightforward process. You can typically obtain your document from your employer’s payroll portal, or through trusted tax preparation websites. This guide will help you navigate the options to ensure you have your W2 form when filing your taxes.

Key Takeaways:

- Employer Portal: Many employers provide access to W2 forms through their own employee portals, where you can download your form after logging in.

- Tax Preparation Software: If you used tax software last year, you might find your W2s stored in your account with that service, ready for download.

- IRS Website: You can access Gusto or Square, independent payroll providers, where employees can log in to obtain their W2 information.

- Direct Request: If you can’t find your W2 online, contacting your employer’s HR department can help you receive a digital copy.

- Third-Party Services: Services like H&R Block and TurboTax may offer W2 retrieval options if they’re linked to your employer.

- Deadlines: Be aware of W2 issuance deadlines, usually by January 31st each year, to ensure timely receipt.

- Status Tracking: For missing W2s after the deadline, you can check with the IRS to track the status of your form.

Understanding the W-2 Form

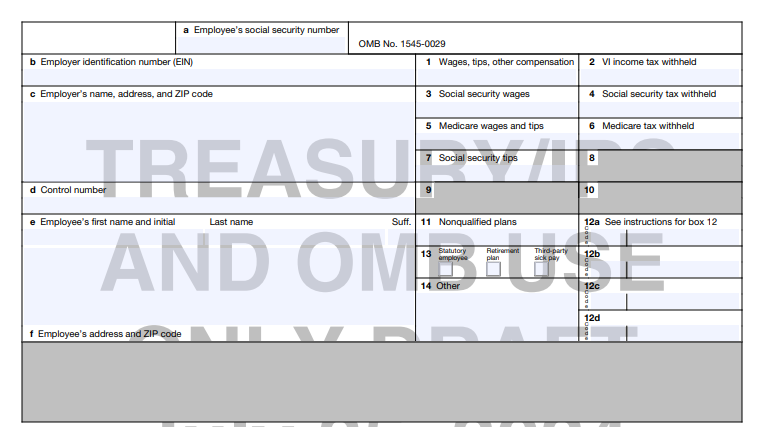

Before you can file your taxes, it’s vital to grasp what the W-2 form entails. This form summarizes your annual wages and the taxes withheld by your employer throughout the year, providing a clear picture of your income for tax purposes.

What is a W-2 Form?

Along with your tax return, the W-2 form is a key document you’ll need at tax time. It is issued by your employer and outlines your earnings, Social Security, and Medicare contributions, as well as any federal and state taxes that have been withheld.

Importance of the W-2 Form

About the W-2 form is vital for accurately reporting your income to the IRS. It’s used not only for your personal tax filing but also to ensure that your employer has correctly withheld the proper amount of taxes from your paycheck.

What makes the W-2 form significant is its role in ensuring you meet your tax responsibilities. The information contained in this document influences your tax refund or liability. If you don’t file your taxes correctly using accurate information from the W-2, you could face penalties or delays. It is also important for verifying your income when applying for loans or renting a house, as it serves as vital proof of your financial standing.

Online Access to W-2 Forms

Even in today’s digital age, accessing your W-2 forms online is convenient and efficient. Most employers now provide a way for employees to view and download their W-2 forms electronically. This eliminates the need for paper forms, making it easier for you to keep track of your tax documents and stay organized. Be sure to check your employer’s guidelines for specific procedures related to accessing your W-2 online.

Employer Portals

On many occasions, your employer will have a dedicated portal where you can securely log in and access your W-2 form. This portal, often part of a larger employee management system, requires your credentials to ensure your information is safe. Look for instructions from your HR department if you haven’t yet used this service.

Third-Party Services

Across various online platforms, several third-party services offer streamlined access to your W-2 forms. These services often provide a user-friendly dashboard that aggregates tax documents from multiple employers, should you have worked for more than one during the tax year.

It’s important to exercise caution when using third-party services for accessing your W-2 forms. While many are legitimate, some may pose security risks that could expose your sensitive information. Always choose reputable providers, and ensure they use encryption methods to protect your data. Double-check reviews and security protocols to ensure your information remains confidential and secure. Additionally, verify that the service complies with IRS requirements for tax form distribution.

Common Issues in Accessing W-2 Forms

Now that you know where to find your W-2 form online, it’s important to be aware of some common issues that may arise during the access process. You might encounter problems such as incorrect login credentials, unresponsive websites, or outdated information. Addressing these issues promptly will help you secure your tax documents in a timely manner.

Technical Difficulties

An issue you may face while accessing your W-2 form online is technical difficulties. This can include slow internet connections, website crashes, or software incompatibility. Ensure that your browser is up to date and consider clearing your cache to mitigate these problems.

Contacting Your Employer

Along with technical difficulties, you may find yourself needing to reach out to your employer for assistance regarding your W-2 form. If you encounter issues accessing your form or if it’s missing altogether, your employer is the best resource to help resolve these problems.

Considering the importance of your W-2 form for your tax filing, not receiving it on time can have serious consequences. Your employer can provide an explanation if the form has not yet been made available or if there were miscommunications regarding its distribution. Don’t hesitate to contact your employer directly through HR or payroll services to ensure you have all the necessary documentation. They will be able to assist in providing you with a copy or directing you to where you can access it securely. Be proactive to avoid delays in your tax submissions and potential penalties.

Timeframe for Availability

Keep in mind that W-2 forms are typically available online from your employer by the end of January each year. This allows you to access your tax documents promptly, ensuring you can file your taxes on time. If you don’t receive your W-2 by mid-February, you should reach out to your employer for clarification.

Annual Filing Deadlines

For tax year 2023, the deadline for employers to send W-2 forms to employees is January 31, 2024. Make sure to watch for your W-2 in your email or online employer portal to avoid delays in filing your taxes.

How to Estimate When Your W-2 Will Be Ready

An effective way to estimate the arrival of your W-2 is to consider your employer’s pay schedule. If your employer issues paychecks bi-weekly, your W-2 could arrive shortly after the last paycheck of January. Additionally, many employers notify employees when tax documents are available electronically, so check your email regularly.

Considering your employer’s timeline can help you plan for tax season. When you are aware of your company’s usual payroll practices, you can better approximate when your W-2 will be accessible online. Some employers also offer direct notifications about the availability of tax documents, which is beneficial. If you find that your W-2 is delayed or missing, reaching out to your HR department promptly can facilitate a swift resolution. Staying proactive ensures you can complete your tax filing without unnecessary stress.

Security Considerations

To ensure a safe experience while accessing your W-2 online, it’s necessary to understand the potential risks and implement effective security measures. Identity theft and online fraud are prevalent concerns that can compromise your personal information. Therefore, you must take proactive steps to safeguard your sensitive data as you navigate online portals for your tax documents.

Protecting Your Personal Information

By keeping your personal information private and secure, you minimize the risk of falling victim to identity theft. Always use strong passwords, avoid sharing your Social Security number unnecessarily, and keep your security questions hard to guess. Furthermore, regularly monitor your financial statements to detect any unauthorized transactions early.

Safe Practices When Accessing Your W-2

Your approach to accessing your W-2 can significantly impact your security level. Always use private, secured connections and avoid public Wi-Fi networks when logging into financial sites. In addition, make sure to keep your antivirus software updated to protect against malware that could steal your information.

This practice is vital to maintaining the integrity of your personal data. Always look for HTTPS in the URL, indicating a secure connection, and steer clear of links in unsolicited emails that may lead to phishing sites. Additionally, enable two-factor authentication where possible to add an extra layer of security. By staying vigilant and following these safe practices, you can help ensure that your W-2 access is both secure and straightforward.

Final Words

Considering all points, obtaining your W-2 form online is a straightforward process that you can navigate with ease. You can access your W-2 through your employer’s payroll system, or if applicable, the IRS website. Ensure you have your credentials ready and check your spam folder for emails regarding document availability. If you encounter any issues, don’t hesitate to reach out to your HR department for assistance. With the right resources, you can secure your W-2 efficiently, streamlining your tax preparation process.

FAQ

1. Where can I access my W-2 form online?

You can typically access your W-2 form online through your employer’s payroll or HR portal. Many companies offer an online system where employees can log in and download their W-2 forms as PDFs. If your employer has not provided such access, it’s recommended to contact your HR department for guidance.

2. What if my employer does not provide an online option for my W-2?

If your employer does not have an online portal for accessing your W-2, you may need to wait for them to mail it to you. Employers are required to send W-2 forms by January 31st each year. If you do not receive it in the mail, you should reach out to your HR department for assistance.

3. Can I get my W-2 form from the IRS?

The IRS does not provide individuals with their W-2 forms directly. However, if you are unable to obtain your W-2 from your employer, you can file Form 4506-T with the IRS to request a transcript of your wage and tax information. This can serve as a substitute for your W-2 when filing taxes.

4. What if I lost my W-2 form and need to access it again?

If you have misplaced your W-2, you can request a duplicate from your employer through their payroll department. Additionally, if your employer provides an online portal, you may be able to log in and download your W-2 again from there.

5. Is there a difference between an electronic W-2 and a paper W-2?

No, there is no difference in the validity or content between an electronic W-2 and a paper W-2. Both forms contain the same tax information and can be used when filing your tax return. However, electronic W-2s may be more convenient for storage and access.

6. What should I do if the information on my W-2 is incorrect?

If you find that your W-2 contains incorrect information, you should contact your employer’s payroll department immediately. They will issue a corrected form (Form W-2c) to reflect the accurate information. Make sure to keep a copy of both the incorrect and corrected W-2 for your records.

7. Can I file my taxes without my W-2?

It is not advisable to file your taxes without your W-2, as it contains crucial information about your earnings and taxes withheld. However, if your W-2 is not available by the tax deadline, you can use your final pay stub of the year as a reference for estimating your income. You can also file for an extension if necessary, but ensure to obtain your W-2 as soon as possible to avoid issues with the IRS.