W2 Tax Form 2025 – You may find yourself in need of your W-2 forms if they are lost or not received from your employer on time. It’s important to act quickly, as these forms are crucial for accurate tax filing. To efficiently request your W-2 from the IRS, you can use Form 4506-T, which allows you to obtain a transcript of your wage and tax information. Additionally, be aware that requesting your W-2 forms can take several weeks, so initiating this process early is advised to ensure you meet tax deadlines.

Key Takeaways:

- Eligibility: You must have worked for an employer who did not provide your W2 form or lost it.

- Use Form 4506-T: Complete and submit IRS Form 4506-T to request a copy of your W2 from the IRS.

- Timing: Allow up to 75 days for the IRS to process your request and send the W2 form.

- Alternative Method: You can also access your W2 online by using the IRS’s “Get Transcript” tool if you have an online account.

- Provide Accurate Information: Ensure your personal information, such as Social Security number and address, is correct on the form to avoid delays.

- Email or Mail: You can submit your request via mail or electronically, depending on your preference and IRS guidelines.

- Keep Records: Save a copy of your request for your records in case you need to follow up.

Understanding W-2 Forms

For anyone earning wages, the W-2 form is an important document that summarizes your annual earnings and the taxes withheld by your employer. It’s a vital piece of information needed to accurately complete your income tax return and ensure compliance with federal tax regulations. Knowing what a W-2 entails is key to understanding your financial obligations during tax season.

What is a W-2 Form?

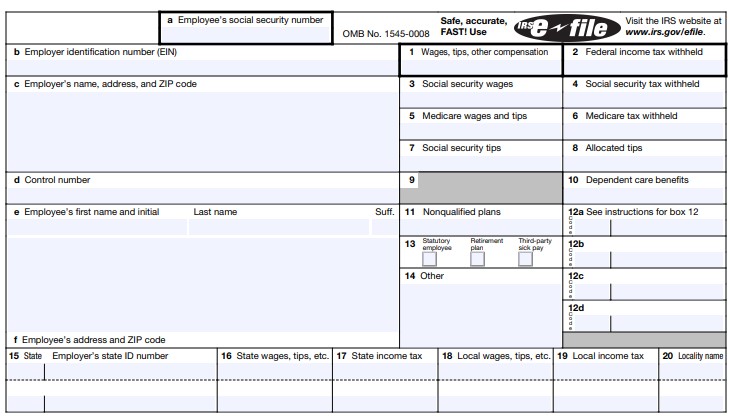

Among the various tax forms you will encounter, the W-2 form reports your income earned as an employee and the taxes withheld by your employer throughout the year. It includes important details such as your total earnings, Social Security, and Medicare contributions, making it a fundamental document for tax filing.

Importance of W-2 Forms for Tax Filing

Beside being a record of your income, W-2 forms are vital for ensuring that you pay the correct amount of taxes owed. They provide the necessary information to complete your tax return accurately, which can help you avoid penalties or, conversely, maximize your refund.

In fact, accurate W-2 information can significantly impact your tax return. If you report incorrect earnings or fail to include your W-2, you risk triggering an audit by the IRS, leading to potential fines or additional taxes owed. Furthermore, if your employer did not withhold enough taxes, it might result in an unexpected tax bill at year’s end. Always ensure that your W-2 forms are complete and correct to maintain your financial health and peace of mind.

When to Request W-2 Forms?

While the IRS typically sends W-2 forms to employees by January 31st, you may find yourself in a situation where you need to request a copy for various reasons, such as if you haven’t received it or if you’ve misplaced it. It’s crucial to be aware of when to initiate this request to ensure you have your tax documents in a timely manner.

Situations Requiring Requests

On occasion, you might not receive your W-2 form due to an employer’s oversight, or if you have changed jobs during the year. Additionally, if you need a copy for tax purposes or for financial documentation, requesting a W-2 form becomes necessary to keep your records complete.

Deadlines for Submission

By mid-April, the IRS recommends that you have all necessary tax documents, including your W-2 forms, filed with your tax return. If you haven’t received your W-2 or need a replacement, it’s advisable to make your request as soon as possible to avoid delays in your filing.

The IRS generally requires that all W-2 forms be submitted by employers to you by January 31st. If you have not received your W-2 by this time, you should promptly request it from your employer. If your employer is unresponsive or you are unable to obtain your W-2, you can contact the IRS directly, but ensure you do this before the tax filing deadline to avoid complications and any potential penalties for late filing.

How to Request W-2 Forms from the IRS?

Once again, if you have not received your W-2 forms from your employer by mid-February, it’s imperative to take action. You can request a copy directly from the IRS to ensure you can file your taxes on time. The IRS can provide you with a transcript or W-2 information for your records. Knowing the proper procedure will help you navigate this process smoothly and get what you need without delay.

Online Request Process

From the IRS website, you can request your W-2 forms using the online tools available. You will need to create an account or log in to access your tax records. This process is straightforward, ensuring you can quickly obtain your necessary documents without hassle.

Requesting via Mail

Along with online requests, you can also obtain your W-2 forms by submitting a written request via mail. This method requires you to complete Form 4506-T, which allows you to request a transcript of your wages and tax information.

With Form 4506-T, you must provide your personal details, including your name, Social Security number, current address, and the tax year you’re inquiring about. You can send the completed form to the appropriate IRS address based on your state. Keep in mind that this process may take several weeks, so it’s best to allow ample time for processing. Make sure to double-check all information on your form to avoid delays that could impact your filing. Additionally, always use a secure mailing method when sending sensitive information to the IRS.

Required Information for Request

Keep in mind that you need to provide specific information to successfully request your W-2 forms from the IRS. This ensures that the agency can quickly locate your records and lessen the chances of any delays in receiving your documents.

Personal Identification Information

Against all odds, the IRS will require you to submit personal identification information, such as your full name, Social Security number, and current address. This data helps the agency verify your identity and confirm your request for the W-2 forms.

Previous Employer Details

Below, you’ll need to include details about your previous employer(s), such as the employer’s name, address, and employer identification number (EIN). This information is important for the IRS to accurately fetch your W-2 records.

And when providing the previous employer details, ensure that you include any corresponding address changes or name variations since employers may have different names that could lead to confusion during the records search. Moreover, if you worked for multiple employers in the same year, list all relevant employers along with the respective dates of employment for each, as this increases the likelihood of a successful retrieval.

Tracking Your Request

Despite submitting your request for a W-2 form, it’s important to stay proactive about tracking its status. The IRS typically processes requests within a few weeks, but delays can occur. You can check the IRS’s website or contact their customer service to inquire about your request. Keeping a detailed record of when you submitted your request and any communications with the IRS will also help ensure that you can follow up effectively if needed.

Follow-Up Procedures

The best practice for following up on your W-2 request is to wait three to four weeks after submitting your application, then check in with the IRS. You can do this by calling their designated helpline or using their online tools. Having your personal information and request details on hand will make this process smoother.

What to Do if You Encounter Issues?

By addressing any issues promptly, you can resolve potential delays in receiving your W-2 form. If your request hasn’t been processed after several weeks, consider reaching out to the IRS directly for assistance.

Procedures for resolving issues with your W-2 request include understanding the possible reasons for a delay, such as incorrect personal information or high request volume. If the IRS needs additional information, they will notify you, so ensure that you respond quickly to any requests they make. If you find it challenging to get a resolution, consider seeking help from a tax professional who can provide guidance based on your specific situation. Your persistence is crucial in ensuring you receive your W-2 form in a timely manner.

Additional Resources

Now that you have a clear understanding of how to request your W2 forms from the IRS, you may find it helpful to explore additional resources for further assistance and information on related tax matters.

IRS Contact Information

To connect with the IRS for any inquiries regarding your W2 forms, you can reach them at 1-800-829-1040, available from 7 AM to 7 PM local time. Have your Social Security number and relevant details handy for efficient support.

Helpful Online Tools

Across the IRS website, a variety of tools can aid you in managing your tax information more effectively. From online request forms to tracking your refund status, these resources are designed to streamline your experience with the IRS.

Another way to enhance your tax experience is by utilizing the IRS online account, where you can access your tax records and view transcripts. Additionally, the Get Transcript service allows you to quickly download or order your tax documents, including W2 forms. The Interactive Tax Assistant can provide answers to specific questions regarding your taxes, which can save you time and stress during the filing process.

To wrap up

Ultimately, requesting your W-2 forms from the IRS is a straightforward process that requires you to gather necessary details such as your Social Security number and the tax year in question. You can make your request by completing Form 4506-T and sending it to the IRS, or by contacting them directly for assistance. Once submitted, allow some time for processing. Keeping track of your W-2s is vital for accurate tax filing, so ensure that you take these steps to secure your forms when needed.

FAQ

1. What is a W-2 form?

A W-2 form is a tax document that reports an employee’s annual wages and the amount of taxes withheld from their paycheck. Employers are required to send W-2 forms to the IRS and their employees by January 31 each year, allowing individuals to file their taxes accurately.

2. Why might I need to request a W-2 form from the IRS?

You might need to request a W-2 form if your employer has not provided it or if you have misplaced it. Additionally, if you are preparing your taxes and cannot locate your W-2, obtaining a copy from the IRS can help ensure that you report your earnings correctly.

3. What information do I need to request a W-2 from the IRS?

To request your W-2 form from the IRS, you should have your personal information ready, including your name, Social Security number, and address. If applicable, also include the employer’s name and employer identification number (EIN) to help the IRS locate your W-2 more efficiently.

4. How can I request my W-2 from the IRS?

You can request your W-2 from the IRS by filing Form 4506-T, Request for Transcript of Tax Return, or by calling the IRS at 1-800-829-1040. Make sure to specify that you want to receive a copy of your W-2. You can also use the IRS’s online tools, such as the Get Transcript service, for assistance.

5. How long does it take to receive my W-2 from the IRS?

Typically, it may take the IRS about 5 to 10 business days to process your request. However, the entire process could take longer during peak tax season or if additional information is needed to verify your identity.

6. What should I do if I receive my W-2 but there are errors on it?

If you find errors on your W-2 form, contact your employer immediately to request a corrected version. They will issue a Form W-2c, Corrected Wage and Tax Statement, reflecting the accurate information. Once you receive the corrected W-2, you can then use it for your tax filing.

7. Is there a fee to request my W-2 from the IRS?

A: No, there is no fee to request your W-2 from the IRS. The request for the transcript or copy of your W-2 is a free service provided by the IRS to help taxpayers with their tax filings.