W2 Tax Form 2025 – Taxes can often be confusing, especially when you come across forms like the 1040 and the W-2. You might wonder whether a 1040 form is the same as a W-2, but they serve distinctly different purposes in the tax filing process. The 1040 form is your annual income tax return, summarizing your financial information, while the W-2 form is a statement from your employer detailing your earnings and taxes withheld throughout the year. Understanding this difference is important for ensuring your taxes are filed correctly and efficiently.

Key Takeaways:

- Different Forms: A 1040 form and a W-2 form are distinct tax documents.

- Tax Filing: The 1040 is an individual income tax return used to report annual earnings.

- Income Reporting: The W-2 provides a summary of an employee’s annual wages and taxes withheld.

- Employers’ Role: Employers are required to issue W-2 forms to their employees by the end of January each year.

- Form Use: A W-2 is typically used to complete the 1040 form when filing taxes.

- Personal Liability: Incorrect information on a W-2 can impact the accuracy of your 1040 filing.

- Tax Software: Many tax filing software programs automatically pull data from W-2 forms when completing the 1040.

Understanding the 1040 Form

A 1040 Form is the standard document used by U.S. taxpayers to file their annual income tax returns with the IRS. This comprehensive form provides a detailed record of your financial activity, allowing you to report your earnings, claim deductions, and determine your tax liability or refund. It serves as a vital tool for ensuring compliance with federal tax regulations while helping you manage your finances effectively.

Definition and Purpose

On its surface, the 1040 Form is designed to collect vital information about your income and tax obligations. It allows you to report your income, claim tax credits, and ultimately calculate the amount you owe or the refund you can expect. The form plays a central role in the U.S. tax system, ensuring accurate reporting and accountability.

Types of Income Reported

Along with earned wages, the 1040 Form accommodates various forms of income you might have received throughout the year. It requires you to report income from different sources, which can significantly impact your overall tax responsibility. Here’s a breakdown of the types of income you may report:

| Income Source | Description |

| Wages and Salaries | Earned income from employment |

| Self-Employment Income | Profits from freelance or business activities |

| Investment Income | Dividends, interest, and capital gains |

| Retirement Income | Pension and annuity payments |

| Other Income | Alimony, rental income, or royalties |

Knowing how to accurately report each type of income is vital to avoid mistakes that could lead to audits or penalties.

Considering the variety of income types, it’s important to gather all relevant documents before filing your 1040 Form. Each income source impacts your taxable income, so accurate reporting is vital. Here’s a detailed table reflecting various income categories:

| Income Type | Reporting Method |

| Wages | Use your W-2 form |

| Self-Employment | Report on Schedule C |

| Interest and Dividends | Use 1099-INT or 1099-DIV |

| Rental Income | Report on Schedule E |

| Pension | Use 1099-R |

Knowing how to properly document each type of income can significantly influence your overall tax calculations.

Overview of the W-2 Form

Now that you understand the basics of tax forms, let’s research into the W-2 form, which is imperative for reporting your annual income. This form is provided by your employer and summarizes your earnings and the taxes withheld during the tax year, allowing you to accurately file your federal and state income tax returns.

Definition and Purpose

Beside being a vital component of the tax filing process, the W-2 form serves as a record of your employment income and tax contributions. It is designed to inform both you and the IRS about how much you earned and the amount of taxes deducted from your paycheck throughout the year.

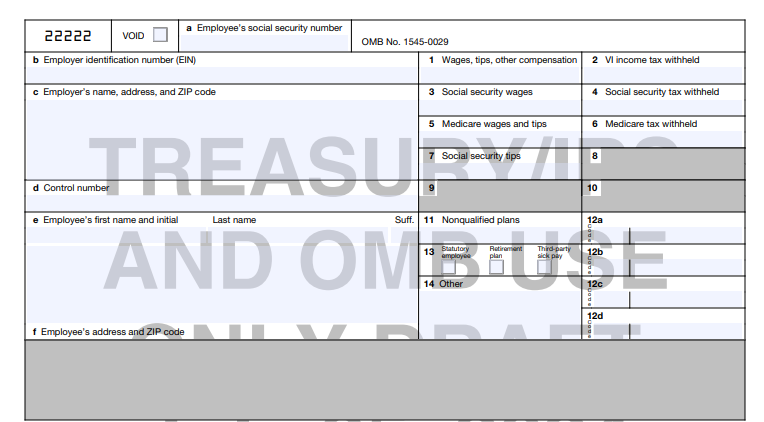

Information Provided on a W-2

After you receive your W-2, you’ll find several key pieces of information that help you complete your tax return. The form includes your total earnings, any federal and state taxes withheld, Social Security and Medicare contributions, as well as any benefits or pay that are subject to tax.

Provided on your W-2 are details like your total wages, withheld federal and state taxes, and FICA contributions. This information is vital for reporting your income accurately. Any discrepancies could lead to issues with the IRS, potentially resulting in penalties or a delayed tax refund. Ensuring that the details on your W-2 match your records will streamline your filing process and help safeguard against any unnecessary complications.

Key Differences Between 1040 and W-2

Once again, it’s important to understand that the 1040 form and W-2 serve very different purposes in the tax process. The W-2 is an earnings statement provided by your employer, reflecting your annual income and taxes withheld, while the 1040 is the individual income tax return you file to report your total income, claim deductions, and calculate your tax liability.

Context of Use

Differences in usage highlight that the W-2 is primarily a document from your employer that helps you track your earnings, while the 1040 is a comprehensive form you complete to file your taxes with the IRS.

Reporting Requirements

An important difference lies in their reporting requirements; the W-2 reports your income and tax withholdings to both you and the IRS, while the 1040 consolidates all your income sources, deductions, and credits to determine your overall tax situation.

And as you prepare your 1040, ensure that you accurately incorporate the information from your W-2. The W-2 form indicates your total wages and taxes withheld, which you must report on your 1040. Failing to include these details can lead to a a false tax return, increasing your risk for audits or penalties. Always double-check your W-2 figures to ensure accuracy in your overall tax filing process.

Scenarios Involving Both Forms

After understanding the distinction between a 1040 Form and a W2, you may encounter situations where both forms are relevant. For instance, if you are employed by a company while also engaging in freelance work, you will receive a W2 from your employer and may utilize a 1040 to report additional income from your self-employment. Knowing how these forms interact can help you ensure accurate reporting and compliance with tax regulations.

Filing Taxes as an Employee

Taxes filed using a W2 indicate that your employer has withheld taxes on your behalf, simplifying the process of fulfilling your tax obligations. When you file your 1040, you will include the income reported on your W2, which will help you calculate your overall tax liability and potential refund. It is important to double-check the amounts on your W2 against your records to avoid discrepancies.

Self-Employment Considerations

Below, consider that if you are self-employed, you will not receive a W2 but may still need to file a 1040 along with a Schedule C or Schedule SE to report your income and calculate self-employment taxes. This adds a layer of complexity to your tax return, as you’ll need to accurately report both your income and any allowable deductions.

Hence, being self-employed means you encounter unique tax responsibilities compared to a traditional employee. Alongside your 1040, you are required to maintain precise records of your income and expenses to accurately report your earnings. Additionally, you must account for self-employment taxes, which include Social Security and Medicare taxes that are not automatically withheld. It is beneficial to set aside a portion of your income throughout the year to cover these obligations and prevent surprises come tax season.

Common Misconceptions

Your understanding of tax documents can often be clouded by myths. Many people mistakenly think that a 1040 form is the same as a W-2, leading to confusion about tax reporting and filing processes. It’s necessary to differentiate between these two important documents to ensure you’re fulfilling your tax obligations accurately.

1040 vs W-2 Confusion

About 1040 forms and W-2s serve different purposes in the tax filing process. While the W-2 is a wage and tax statement provided by your employer, summarizing your earnings and tax withholdings for the year, the 1040 form is your individual income tax return that you file with the IRS.

Importance of Accurate Tax Reporting

The accuracy of your tax reporting can significantly affect your financial situation. Incorrectly reporting income or deductions on your 1040 form due to W-2 misunderstanding might result in penalties or audits. This detail emphasizes the importance of double-checking all your documents and ensuring you properly understand each form’s role in your tax return.

To maintain financial integrity and avoid complications with the IRS, you must ensure accurate tax reporting. Using your W-2 to correctly fill out your 1040 form is necessary. Failing to do so can lead to unintended tax liabilities, penalties, or even fraud accusations, which can be damaging both financially and personally. Always verify your information and seek assistance if needed to file your taxes confidently.

Final Words

Drawing together the information, it’s clear that a 1040 form is not a W-2. While both are necessary components of your tax obligations, the 1040 form is the individual income tax return you file, while the W-2 form is provided by your employer to report the income you’ve earned and the taxes withheld during the year. Understanding the distinction between these forms will help you navigate your tax filing process more effectively.

FAQ

1. What is a 1040 Form?

The 1040 Form is an individual income tax return form used by U.S. taxpayers to report their annual income, claim tax deductions and credits, and calculate their tax liability or refund. It is the standard form for filing federal income tax returns in the United States.

2. What is a W-2 Form?

The W-2 Form, officially called the Wage and Tax Statement, is a document that employers send to their employees at the end of the year. It details the employee’s annual earnings, as well as the taxes withheld from their paychecks for Social Security, Medicare, and federal income tax.

3. Is a 1040 Form the same as a W-2 Form?

No, a 1040 Form and a W-2 Form are not the same. The 1040 Form is used by individuals to file their tax returns, while the W-2 Form is used by employers to report the earnings and tax withholdings for their employees. The W-2 Form is one of the documents that taxpayers may use to complete their 1040 Form.

4. How do I use a W-2 when filing my 1040 Form?

When filing your 1040 Form, you will need to input the income information from your W-2 Form. This includes wages, tips, and other compensation reported in Box 1 of the W-2. The taxes withheld, reported in Boxes 2, 4, and 6, may also be needed for accurate completion of your 1040 Form.

5. Can I file my 1040 Form without a W-2?

It is possible to file your 1040 Form without a W-2 if you do not have any income reported on that form. However, if you received wages from an employer and do not include a W-2, it may lead to inaccuracies in your tax return. In this case, consider getting a copy of your W-2 from your employer or the IRS before filing.

6. What should I do if my W-2 is incorrect?

If you notice that your W-2 Form contains incorrect information, contact your employer immediately to request a corrected version. Employers are required to issue accurate W-2s, and if they issue a corrected form (a W-2c), ensure you use that information when completing your 1040 Form to avoid discrepancies.

7. What happens if I only receive a 1099 but not a W-2?

If you receive a 1099 Form instead of a W-2, it typically indicates that you were an independent contractor or received income from sources other than employment (such as freelance work or dividends). You will report this income on your 1040 Form using the appropriate sections for self-employment income or other types as indicated by the 1099.