W2 Tax Form 2025 – There’s a chance you may need your W2 form from a previous employer for tax filing or financial verification. Obtaining this document is vital for ensuring your income is accurately reported and could impact your tax refund. You should first contact your former employer’s HR department for assistance. If that doesn’t yield results, consider reaching out to the IRS, as they can provide you with a transcript. Be proactive in securing this document to avoid delays in your tax preparation and potential issues with the IRS.

Key Takeaways:

- Contact HR Department: Reach out to the Human Resources department of your previous employer to request your W2 form.

- Provide Identification: Be prepared to verify your identity by providing necessary personal details such as your Social Security number and employment dates.

- Use Online Platforms: Check if your former employer has an online portal where you can access or download your W2 form directly.

- Request Assistance Early: Make your request early in the tax season to ensure you receive your form in a timely manner.

- Follow-Up: If you do not receive a response within a few weeks, follow up with the HR department to check the status of your request.

- File a Complaint: If your former employer fails to provide the W2 form, you can file a complaint with the IRS for further assistance.

- Alternative Documentation: If necessary, use alternative documents such as pay stubs to estimate your earnings for tax filing purposes.

Understanding the W-2 Form

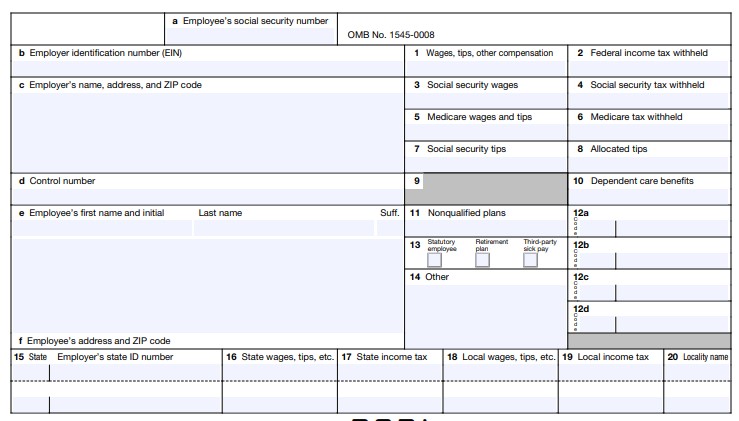

As you navigate your financial responsibilities, comprehending the W-2 form is necessary for accurate tax reporting. This form is issued annually by your employer, detailing your earnings and the taxes withheld from your paychecks during the tax year. It serves as a summary of your income, helping you report your earnings to the IRS and ensuring that you remain compliant with tax regulations.

What is a W-2 Form?

Between employers and the IRS, the W-2 form plays a vital role. It is a document that summarizes your annual income and the amount of taxes withheld from your paycheck. Employers are required to furnish this form to employees by January 31st each year, allowing you to accurately file your tax returns and maintain your financial records.

Importance of the W-2 Form

Between filing your tax return and ensuring proper documentation, the W-2 form is indispensable. It provides the information you need to accurately calculate your taxable income and determine any refunds or liabilities you may have. Without this form, you might struggle to report your earnings correctly, leading to potential penalties or delays in your tax processing.

Another critical aspect of the W-2 form is its role in maintaining transparency between you and the IRS. It helps protect you from over-reporting or under-reporting your income, which can have serious ramifications. Additionally, accurately filing your taxes using the W-2 form ensures you receive any refunds due, as well as allows you to qualify for potential financial opportunities, such as loans or mortgages, that may require proof of income.

Contacting Your Previous Employer

There’s a process to follow when reaching out to your previous employer for your W2 form. It’s crucial to be polite and concise in your request. Many companies have designated personnel or departments for handling such inquiries, so be prepared to provide them with the information they need to assist you.

Tips for Reaching Out

To improve your chances of a quick response, consider the following tips:

- Be courteous in your communication.

- Specify your request for the W2 form clearly.

- Use email or a direct phone call for efficiency.

- Follow up if you don’t receive a timely reply.

Recognizing the significance of effective communication can streamline the retrieval of your document.

Information to Provide

Between your request and the employer’s response, you should provide specific information to aid their search for your W2 form. Include your full name, social security number, the years you worked there, and possibly your department or title.

At a minimum, you must provide your full name at the time of employment and the correct social security number. Including the dates of hire and termination will also facilitate the process. Providing this detailed information helps the HR department quickly locate your records, ensuring that you receive your W2 form promptly. Additionally, if you moved after leaving the company, be sure to mention your current address to avoid any delivery issues.

Alternative Methods to Obtain a W-2 Form

For those unable to get their W-2 from a previous employer directly, there are alternative methods you can explore. Utilizing the IRS Form 4506-T, contacting your online payroll service, or reaching out to the IRS can all help you obtain the necessary documentation to file your taxes accurately.

IRS Form 4506-T

For a more official route, you can request your W-2 using the IRS Form 4506-T. This form allows you to obtain a transcript of your tax return, which can serve as a substitute for your W-2. It is important to complete and submit it promptly, as it may take weeks to process.

Online Payroll Services

Any company that utilized online payroll services for their employees may provide you access to your W-2. Simply log into the payroll platform, and you may find your tax documents readily available for download.

In fact, using online payroll services can simplify your search for past W-2 forms. Many businesses use user-friendly platforms that allow you to access tax documents easily. If you were employed at a company that offered this service, all you need is your login credentials to obtain your W-2. You can quickly download or print your form for your records. However, if you’re having trouble gaining access, don’t hesitate to reach out directly to the employer or payroll provider for assistance.

Deadlines and Timeframes

Despite the challenges that can arise when seeking your W-2 from a previous employer, being aware of deadlines and timeframes is imperative. The IRS mandates that employers must send out W-2 forms by January 31st each year, which gives you a solid timeframe for anticipating your document. However, if you’re expecting one from an employer that may have closed or changed management, the timeline might vary, so stay proactive in your request.

When to Expect Your W-2

Your W-2 should ideally arrive by the end of January but can sometimes be delayed due to postal issues or employer oversight. If you haven’t received it by mid-February, it’s advisable to reach out directly to your former employer for clarity and to make sure it was sent correctly.

What to Do if You Miss the Deadline

On the chance that you miss the January 31st deadline to receive your W-2, take immediate action to rectify the situation.

Indeed, if you find yourself missing the deadline, first, contact your previous employer to request a duplicate W-2. If they are unresponsive or unable to provide one, you can also reach out to the IRS for assistance after February 15th. They will need your personal details and any information regarding your employment. This situation can be overwhelming, but filing Form 4852 as a substitute for your W-2 will allow you to still file your taxes without further delays. Be sure to keep detailed records as the IRS may require them for verification.

Troubleshooting Common Issues

All employees may encounter problems when trying to obtain their W-2 forms from previous employers. It’s necessary to understand these common issues so you can effectively address them and ensure you receive the correct documents on time. By being proactive and knowing what steps to take, you can mitigate frustration and successfully retrieve your W-2 form without undue stress.

Incorrect Information on W-2

Incorrect details on your W-2 can lead to complications when filing your taxes. If you discover any discrepancies—such as an erroneous Social Security number or inaccurate income figures—you should contact your former employer immediately to request a corrected form. Receiving an accurate W-2 is vital for proper tax filing and avoidance of IRS penalties.

Not Receiving Your W-2 Form

Your W-2 form may not arrive by the expected deadline for various reasons, including outdated addresses or mailing errors. If you haven’t received your W-2 by mid-February, it is advised to reach out to your previous employer’s payroll department to verify your mailing information and inquire about the status of your form.

For instance, if you’ve recently moved and forgot to update your address with your former employer, this can delay your W-2 delivery. If you do not receive your form, you should ask your employer to send a duplicate. Additionally, keep in mind that some companies may opt to deliver W-2s electronically, so confirm if this option was available and whether you need to access an online portal. Taking these steps ensures that you obtain your W-2 form, allowing you to file your taxes promptly and avoid potential issues with the IRS.

Now that you understand the steps to obtain your W-2 form from a previous employer, you can ensure that you have all the necessary documents for your tax filings. Start by contacting your former employer’s HR or payroll department, check your online employee portal, and don’t hesitate to request an IRS Form 4506-T if needed. Keeping your records organized can streamline this process and minimize any delays in receiving your important tax information.

FAQ

1. What is a W-2 form?

A W-2 form is a document that employers in the United States are required to send to their employees and the Internal Revenue Service (IRS) at the end of each tax year. It reports an employee’s annual wages and the amount of taxes withheld from their paycheck.

2. Why do I need my W-2 form from a previous employer?

You need your W-2 from a previous employer to accurately file your taxes. It contains crucial information regarding your income and withheld taxes, which is necessary for reporting your earnings to the IRS and determining your tax obligation or refund.

3. How can I request my W-2 form from a previous employer?

You can request your W-2 form by contacting the HR or payroll department of your previous employer. It’s best to do this via email or a formal letter, stating your request clearly and providing your employment details such as your name, Social Security number, and the year for which you need the W-2.

4. What if my previous employer is no longer in business?

If your previous employer is no longer in business, you can still obtain your W-2 form from the IRS. You can file Form 4506-T to request a transcript of your W-2 information. You may also have to provide pay stubs or other proof of income for filing your taxes.

5. How long should I wait to receive my W-2 form after requesting it?

After you submit your request, employers are typically required to respond within a reasonable timeframe. You should allow at least 1-2 weeks. However, this may vary based on the employer’s policies and how they manage payroll inquiries.

6. What if I don’t receive my W-2 form by the tax filing deadline?

If you haven’t received your W-2 by the tax filing deadline, you should file your taxes using other income documents like your pay stubs. Additionally, you can contact the IRS for guidance, and they may help in obtaining the necessary information from your employer.

7. What information should I provide when requesting my W-2 form?

When requesting your W-2 form, include your full name, Social Security number, the years you worked at the company, your contact information, and possibly your last known address. Providing as much detail as possible will help the employer locate your records more efficiently.