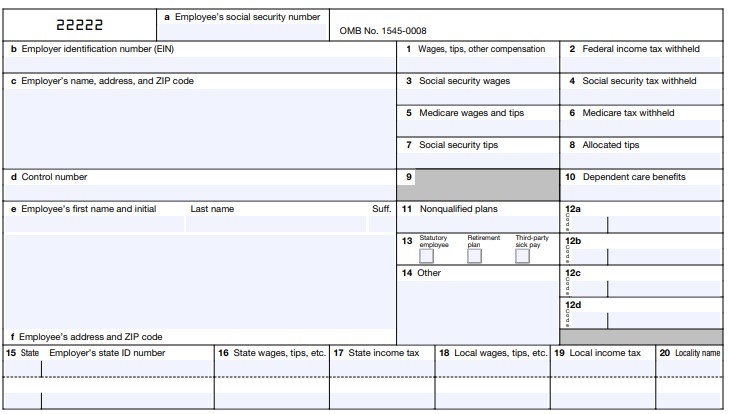

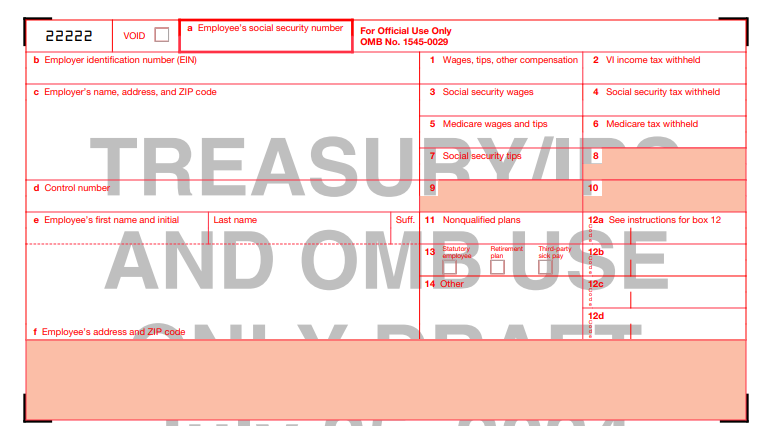

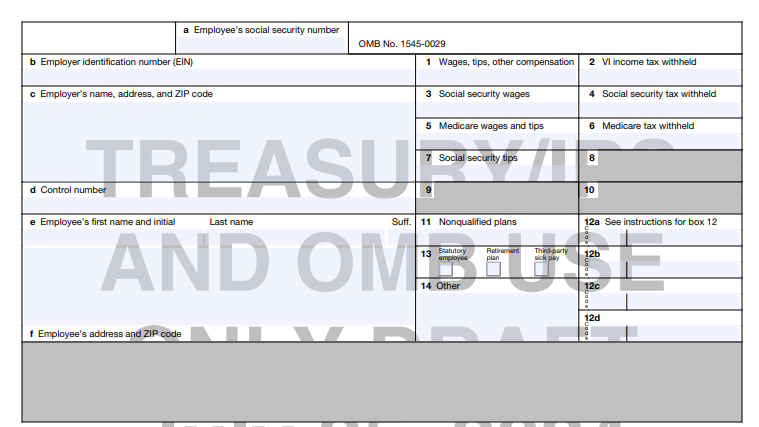

When Will I Get W2 Form?

W2 Tax Form 2025 – Most employees eagerly anticipate receiving their W-2 forms, as they are necessary for filing taxes accurately. You can generally expect to receive your W-2 form from your employer by January 31st each year. It’s important to keep an eye out because delays or issues can arise, affecting your ability to … Read more