Is a 1099 Form the Same as a W2?

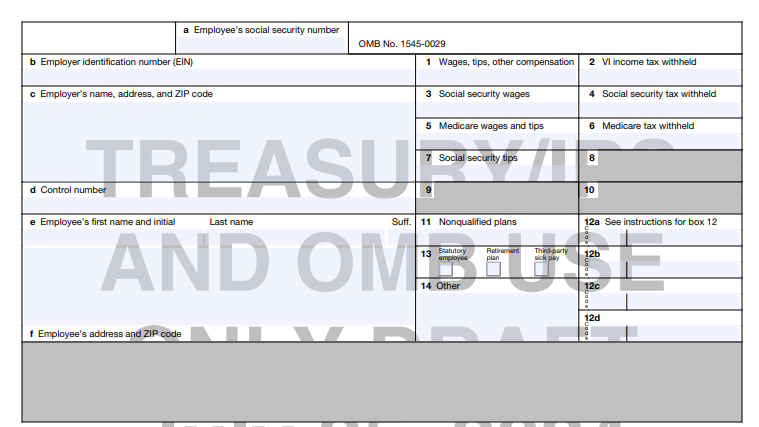

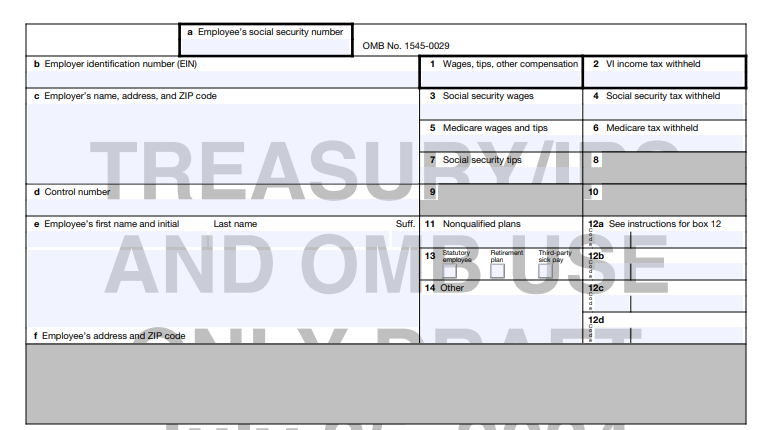

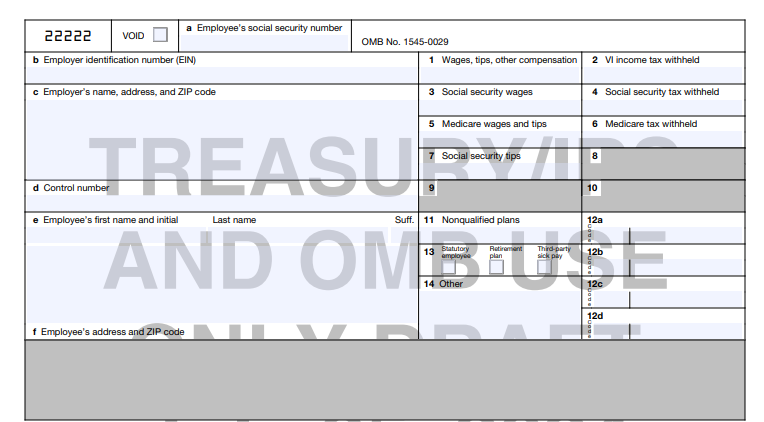

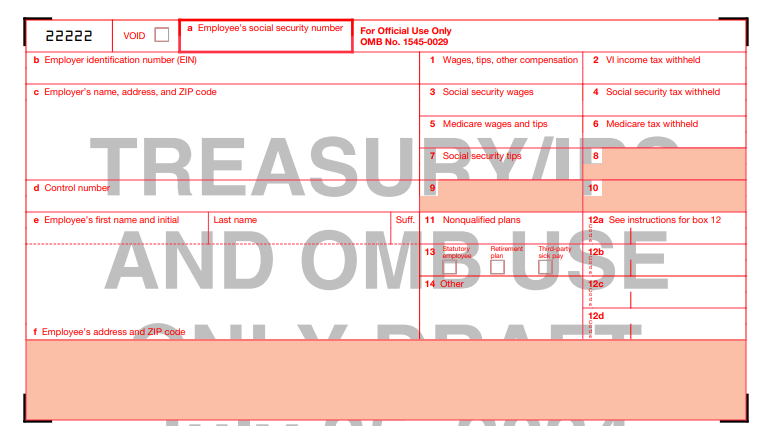

W2 Tax Form 2025 – Just as you navigate your tax responsibilities, it’s vital to understand the differences between a 1099 form and a W-2. While both are used to report income, they serve distinct purposes and apply to different types of employment. If you work as an independent contractor or freelancer, you’ll likely receive … Read more