W2 Tax Form 2025 – It’s crucial for you to understand Line 12A on your W2 Form, as it directly influences your tax filing accuracy. This line shows specific income types or tax deductions that must be reported, affecting your overall tax liability. Common entries in Line 12A may include things like federal tax withheld or retirement plan contributions, making it vital for your financial planning. Being aware of what’s reported here can help you avoid potential issues with the IRS and maximize your tax benefits.

Key Takeaways:

- Line 12A on a W2 form reports specific tax-related information regarding your compensation.

- Income Type: The amounts listed on Line 12A may refer to various types of earnings, such as non-qualified plans.

- Codes: The letter ‘A’ in Line 12A signifies a specific code used by the IRS to identify the type of income or deduction reported.

- Reporting Requirements: Employers must adhere to IRS guidelines when completing this section of the W2 form.

- Impact on Taxes: Amounts on Line 12A can affect your overall taxable income and tax return calculations.

- Tax Preparation: It’s important to review and understand Line 12A to ensure accurate tax filing.

- Consultation Recommended: If unsure about the information on Line 12A, consider consulting a tax professional for clarity.

Understanding the W-2 Form

A W-2 form is an crucial document that employers must provide to their employees each year. It reports an individual’s annual earnings along with the amount of taxes withheld from their paychecks. This form is necessary for accurately preparing your federal and state tax returns.

What Is a W-2 Form?

What you need to know about a W-2 form is that it serves as a record of your income and taxes withheld for a specific calendar year. You will receive this form from your employer and it helps you report your earnings to the IRS when filing your taxes.

Key Components of the W-2

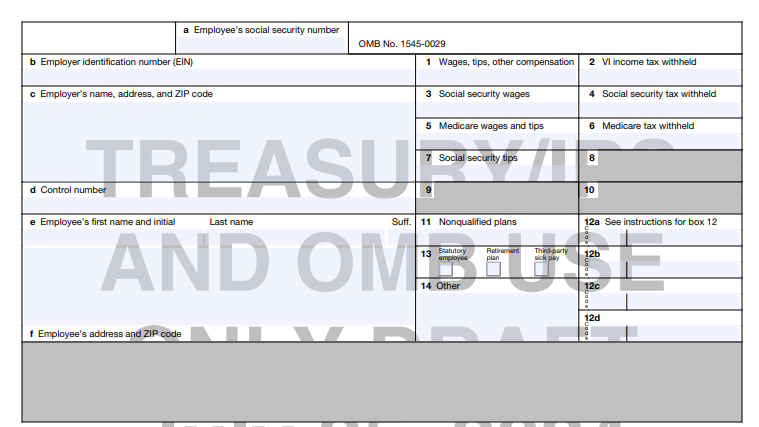

To effectively utilize your W-2 form, it’s crucial to understand its key components. This includes your total wages, federal and state tax withholdings, Social Security and Medicare contributions, and other deductions that may affect your overall tax obligations.

Components of the W-2 include Box 1, showing your total taxable wages, and Box 2, indicating the total federal income tax withheld. The form also presents your Social Security wages and Medicare wages, helping you keep track of your contributions towards these programs. Employer identification numbers and year-end summaries are also listed, ensuring all necessary details are available for your records. Together, these details form the backbone of your tax reporting.

The Significance of Line 12A

The significance of Line 12A lies in its role as a reflection of your tax benefits or contributions that affect your overall tax return. This line is necessary for understanding your financial situation and ensuring proper reporting of any deductions or credits you may qualify for. It serves as a reminder to stay informed about your taxable income and the various ways you can maximize your financial benefits.

What Does Line 12A Represent?

On your W-2 form, Line 12A indicates any employee contributions to a Section 401(k) plan. This pre-tax contribution reduces your taxable income, thus, allowing you to save for retirement while minimizing your current tax liability.

Common Uses for Line 12A

Against the backdrop of retirement planning, Line 12A serves to document your 401(k) contributions, allowing you to benefit from tax deferral. This line helps reflect how much you’ve contributed to your savings and the potential growth you can achieve over time.

At the end of the year, the amounts reported on Line 12A may influence your retirement savings strategy. By maximizing your contributions, not only do you reduce your current tax bill, but you also build a larger nest egg for the future. Additionally, understanding the implications of this line can empower you to make informed decisions regarding your financial health and retirement planning. This insight may also guide you in adjusting your contributions for the following tax year to optimize your benefits.

How Line 12A Affects Your Taxes

To understand how Line 12A affects your taxes, it’s important to recognize its role in reporting additional compensation. This line often includes amounts related to contributions to retirement plans or other employee benefits that may be deductible, impacting your overall taxable income. Recognizing these figures can significantly influence your tax liability and planning strategies, enabling you to make informed decisions about your financial future.

Reporting Income and Deductions

On Line 12A, you’ll report various forms of income and deductions that impact your taxable earnings. These entries can reflect information such as contributions to retirement accounts or other benefits. Accurately reporting this information helps you determine your adjusted gross income (AGI) and can lead to potential tax savings.

Tax Implications of Line 12A

By accurately accounting for amounts reported on Line 12A, you can assess the full extent of your tax implications. Failure to report these figures correctly may lead to unexpected liabilities or missed deductions, affecting your overall tax burden.

Income reported on Line 12A can have significant implications on your tax return. If you view it as additional income, it may push you into a higher tax bracket. Alternatively, if it’s connected to tax-deductible contributions, it can reduce your taxable income, potentially lowering your tax burden. Understanding the dual nature of these entries is vital for optimizing your tax strategy, as neglecting to report or miscalculating can result in penalties or missed opportunities for savings.

Examples of Line 12A Entries

After understanding what Line 12A represents on your W2 form, you might wonder about specific examples of entries you could find there. Common entries for Line 12A include amounts related to retirement plans like 401(k) contributions, and certain employee benefits that qualify as pre-tax deductions. These entries can vary widely depending on your employer’s offerings and how they classify these contributions, providing you insight into your total compensation package.

Typical Situations for Reporting

With various employer scenarios, reporting on Line 12A typically occurs when you contribute to retirement accounts or participate in qualified benefit programs. For instance, if you’ve made pre-tax contributions to a health savings account or a 401(k), you’d see those amounts listed here. It’s important to check for accuracy, as these figures impact your taxable income.

Variations Across Different Employers

Between employers, the entries on Line 12A can differ significantly, reflecting the variety of benefits offered. Some companies may include various types of contributions, such as insurance premiums or other non-taxable benefits. This means that your Line 12A entry may not be the same as a co-worker’s, even if you occupy similar positions.

Employers may choose different formats for reporting amounts on Line 12A, which can lead to discrepancies in how you interpret the benefits. For instance, some might include only retirement contributions, while others may encompass a broader range of benefits. It is vital to review your employer’s specific practices and understand how these entries directly affect your taxable income and overall financial situation. If you notice any inconsistencies, don’t hesitate to communicate with your HR department for clarification to ensure accuracy in your financial reporting.

How to Read and Interpret Your W-2

Not all W-2 forms are the same, so understanding how to read yours is necessary to accurately filing your taxes. Your W-2 provides a summary of your annual earnings and taxes withheld, which you’ll need to complete your tax return. Each box on the form contains specific financial information that affects your tax liability. Pay close attention to the federal, state, and local tax withholding amounts, and ensure they align with your financial situation for the year.

Step-by-Step Guide

Around the time your W-2 arrives, it’s beneficial to have a systematic approach to reading it. Use the following table to break down each section:

W-2 Sections Breakdown

| Box Number | Description |

| Box 1 | Wages, tips, other compensation |

| Box 2 | Federal income tax withheld |

| Box 16 | State wages, tips, etc. |

Common Mistakes to Avoid

Any misinterpretation of your W-2 can lead to significant errors in your tax return. One common mistake is overlooking the state and local tax information, which varies by jurisdiction. Additionally, failing to check if your personal information is accurate may cause issues with your tax filing. Always ensure your wages in Box 1 match your income records to avoid discrepancies.

The importance of accurately interpreting your W-2 cannot be overstated. Failing to double-check your tax withholding or missing out on deductions due to incorrect entries can impact your tax outcome. If your W-2 reflects incorrect amounts, it’s necessary to contact your employer for a corrected form before filing. Taking the time to ensure everything is accurate will lead to a more successful and stress-free tax filing process.

Frequently Asked Questions

Unlike other items on your W2 form, Line 12A specifically pertains to your contributions to certain types of retirement plans, such as a 401(k). Understanding this line is key to accurately reporting your income and potential deductions on your tax return. If you have further questions about your W2, it’s beneficial to seek clarity to ensure you file correctly.

Who Should File Using Line 12A?

Across various employment situations, individuals who contribute to employer-sponsored retirement plans will find Line 12A relevant. If you’ve made contributions to a 401(k) or similar plan, you should check this line as it directly affects your taxable income and retirement savings strategy.

Contacting the IRS for Clarifications

Should you have any uncertainties regarding Line 12A or your W2 form in general, contacting the IRS can provide the answers you need. They offer resources to help you understand what is required and guide you through the filing process.

It’s recommended that you reach out to the IRS if you have questions about your W2 form. They can clarify specific items, including Line 12A, ensuring you understand how your contributions may affect your tax obligations. Engaging with them can help you avoid potential mistakes that could lead to delays or penalties in your tax filing. Be prepared with your details for a more productive conversation.

Summing up

With this in mind, understanding Line 12A on your W2 form is important for accurately reporting your income and deductions. This line typically indicates the amount of money you contributed to a retirement plan, which can impact your tax liability. By knowing how to correctly interpret this line, you can ensure that you take advantage of any potential tax benefits, helping you to make more informed financial decisions. Be sure to consult tax resources or professionals if you have any uncertainties regarding your W2 and its implications for your taxes.

FAQ

1. What is Line 12A on a W-2 Form?

Line 12A on a W-2 form is specifically used to report certain types of compensation or benefits that need to be identified with a corresponding code. It is often linked to specific tax implications or deductions applicable to the employee’s income.

2. What kind of information is reported on Line 12A?

Line 12A may report various types of compensation, such as non-taxable contributions to retirement plans like a 401(k) or other benefits provided by the employer. The specific code used relates to the type of compensation being reported.

3. How do I know what code is used in Line 12A?

Employers use standardized codes provided by the IRS to indicate what type of compensation is being reported on Line 12A. You can refer to the IRS Copy of Form W-2 instructions to find out what each code signifies.

4. Do I have to report the amount shown in Line 12A on my tax return?

Whether you need to report Line 12A on your tax return depends on what the amount represents. Some non-taxable contributions reported in Line 12A do not need to be included in your taxable income, while other amounts may need to be reported differently based on tax regulations.

5. Can I contribute more than the amount shown in Line 12A to my retirement account?

Yes, you can contribute more to your retirement account than the amount shown in Line 12A. However, it’s important to adhere to the annual contribution limits set by the IRS to avoid penalties on excess contributions.

6. What if Line 12A is incorrect on my W-2 Form?

If you notice an error on Line 12A, it is advisable to contact your employer for correction. They can issue a corrected W-2 (Form W-2c) if necessary, to ensure that your tax filings are accurate.

7. Where can I find additional resources about Line 12A on my W-2 Form?

For further information about Line 12A and other parts of the W-2 Form, you can visit the IRS website which provides detailed instructions, or consult a tax professional who can offer tailored advice based on your specific situation.