W2 Tax Form 2025 – W2 forms play a significant role in reporting your annual earnings and tax obligations to the IRS. One section you may notice is Box 14, which provides space for various additional information that may not be captured in other boxes. This box can include details about specific deductions, such as union dues, or other forms of compensation, making it vital for accurately filing your taxes. Understanding the contents of Box 14 can aid you in navigating your tax returns more effectively.

Key Takeaways:

- Box 14 Purpose: Box 14 on the W2 form is used to report various types of income or deductions that are not listed elsewhere on the form.

- Diverse Entries: It can include items such as union dues, educational assistance, and employer-paid benefits.

- State-Specific Needs: Some states may require specific information to be reported in Box 14 for state tax purposes.

- Non-Taxable Amounts: Amounts listed in Box 14 may not be taxable but could still impact other areas of your tax return.

- Employer Guidance: Employers typically provide descriptions for the entries, helping employees understand the reported amounts.

- Consultation Recommended: It is wise to consult a tax professional if unsure how to treat entries in Box 14.

- Accuracy Essential: It’s important to ensure the accuracy of the information in Box 14 to avoid issues with filing your tax return.

Understanding the W-2 Form

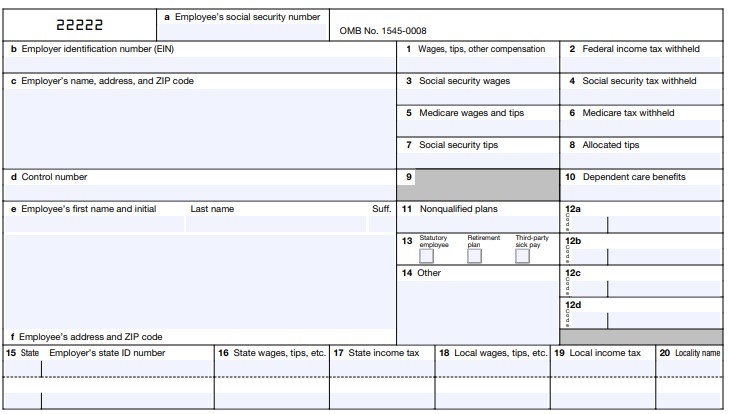

The W-2 form is a vital document used in the United States that reports your annual wages and the taxes withheld from your paycheck. Employers must provide this form to their employees by the end of January each year, allowing you to accurately file your income tax return. It includes various boxes detailing specific financial information critical for tax purposes.

Overview of the W-2 Form

Above, we discussed that the W-2 form is crucial for reporting your income. This form is typically divided into several boxes, each serving a purpose in detailing your earnings and the taxes which have been paid out during the year. Understanding the information presented in your W-2 can aid you in preparing your taxes accurately.

Importance of Box 14

Behind the standard income and tax withholding information, Box 14 on the W-2 form allows you to report additional types of compensation or deductions that aren’t captured elsewhere on the form. This box can include details such as union dues, educational assistance, or specific state taxes that you might need to address in your tax filings.

Understanding Box 14 is crucial because it can impact your overall tax liability significantly. If you overlook this box, you could miss out on deductions that could reduce the amount of tax you owe. Additionally, some amounts reported in Box 14 might not be subject to federal tax but could affect your state tax filings, leading to potential obligations or refunds. Paying attention to these details ensures you maintain accurate and compliant tax records.

Common Entries in Box 14

Assuming you receive a W-2, Box 14 will often contain various entries that pertain to additional information about your income or deductions. These entries can include items like union dues, educational assistance, or health insurance premiums, which help clarify your tax situation. Understanding the details in this box can assist you in accurately reporting your income and optimizing your tax returns.

Examples of Box 14 Codes

One common example of a Box 14 code is “Nontaxable fringe benefits,” which indicates amounts received that are not subject to federal income tax. Another example includes “State disability insurance,” reporting deductions related to state programs.

Reporting Requirements

Among the important aspects of reporting, you must accurately include the information provided in Box 14 when filing your tax return. This ensures that you adhere to IRS guidelines and prevent any discrepancies that might trigger an audit.

To accurately report the entries in Box 14, pay close attention to the specific requirements related to each code. Some items may affect your overall taxable income, while others may qualify for deductions or credits. Failing to report important information from Box 14 could lead to potential issues with the IRS and may prevent you from receiving maximized deductions on your return. Always cross-reference with form instructions or consult a tax professional to ensure complete compliance.

How to Interpret Box 14 Information?

Not all employers fill out Box 14 in the same way, which means you need to pay close attention to the specific codes and descriptions provided. The information in this box can reflect various types of compensation or contributions, such as state disability insurance or other deductions. Understanding what your employer has reported will help you accurately assess your overall taxable income and deductions for the year.

Impact on Tax Filing

Between understanding what each entry in Box 14 means and how it may affect your tax return, you’ll gain a clearer picture of your financial situation. Each item listed could impact your taxable income and potential refund, so ensure you consult these entries when preparing your tax return.

Additional Tax Considerations

For some entries in Box 14, you may need to consider the implications on your overall tax situation. Certain items may require additional tax forms or affect your eligibility for deductions or credits.

But, if you find entries in Box 14 that concern you, such as extra taxable income or significant deductions, it’s wise to seek professional tax advice. These details can lead to unexpected tax liabilities or opportunities for additional savings. Always take the time to thoroughly review any relevant forms and consult a tax professional if needed, to avoid missing important details that could impact your financial health.

Common Mistakes Related to Box 14

Once again, Box 14 on your W-2 can be a source of confusion, leading to common errors during tax preparation. Many taxpayers overlook this section or misinterpret the information it contains, which can result in discrepancies in your tax return. Ensuring you understand and accurately report the information from Box 14 is necessary for a smooth filing process and minimizing the risk of penalties.

Misinterpretation of Codes

Codes in Box 14 can represent a variety of important items, from union dues to moving expenses. If you don’t fully understand what each code signifies, you may incorrectly assume that it doesn’t apply to your taxes or that it means something entirely different, leading to further errors in your reporting.

Incorrect Reporting

Below, it’s important to accurately report the information from Box 14 to avoid complications with the IRS. Failing to do so can result in improper deductions or unreported income, leading to unexpected tax bills or potential audits.

Incorrect reporting often stems from misunderstanding what the entries in Box 14 signify. You might overlook the inclusion of certain deductions or mistakenly include amounts that should not be reported. This can lead to financial penalties and wasted time correcting errors. To ensure accuracy, it’s advisable to double-check the entries in Box 14 against your records and consult a tax professional if you’re unsure about any of the codes or their implications for your tax filings.

Frequently Asked Questions

To address the common concerns regarding Box 14 on your W-2 form, it’s crucial to understand what this box represents and how it can impact your tax filing. You may have various entries in this box specific to your employer, which could include information on wage garnishments, union dues, or other taxable benefits. If you have questions, don’t hesitate to reach out to your tax professional for tailored advice.

Clarifications About Box 14

Across different employers, the contents of Box 14 can vary significantly, leading to confusion about what specific entries mean. This box is used for a number of informational purposes, so while it may appear cluttered, each entry could be vital for your filings. Make sure you understand each item reported to avoid discrepancies.

Resources for Further Assistance

Along your journey to understanding your W-2, there are several resources available for additional help. Your employer’s HR department can clarify the details regarding Box 14 entries, and the IRS website provides comprehensive guidance on tax forms. Utilizing professional tax software can also provide insights tailored to your specific situation.

For instance, leveraging IRS resources can help you navigate tax codes effectively, ensuring your entries are filled out accurately. If you encounter complex issues, seeking assistance from a certified accountant can provide peace of mind, as they are well-versed in current tax regulations. Additionally, online tax forums allow you to connect with others who face similar questions, making it easier to find helpful answers.

Now that you understand what Box 14 on the W-2 form represents, you can better interpret your tax documents. This box offers important information regarding specific items deducted from your wages, which can impact your tax filing. By paying attention to the details in Box 14, you ensure that you’re accurately reporting any necessary deductions or credits, ultimately making your tax preparation process smoother. Always consult with a tax professional if you have questions about how this information applies to your specific situation.

FAQ

1. What is Box 14 on the W-2 form?

Box 14 on the W-2 form is used to report additional information related to an employee’s income or benefits. It is not limited to any specific type of information and can include items such as state disability insurance, uniform expenses, or other deductions that the employer wishes to communicate to the employee.

2. Why is Box 14 important?

Box 14 is important because it provides employees with pertinent information that may affect their tax return or benefit calculations. For instance, amounts reported can influence personal deductions or credits, and help employees understand how their pay is structured.

3. What types of information can be reported in Box 14?

Various types of information can be reported in Box 14, including but not limited to: union dues, state disability insurance, health insurance premiums, educational assistance payments, and contributions to retirement plans not reported elsewhere on the W-2.

4. How should I report the information from Box 14 on my tax return?

The information in Box 14 may not have a direct impact on your tax return unless specifically instructed. It is advisable to refer to the accompanying documentation provided by your employer or consult with a tax professional to determine if and how the amounts reported pertain to your tax return.

5. Do employers have to fill out Box 14?

No, employers are not required to fill out Box 14 on the W-2 form. However, if they choose to do so, they must provide accurate information about the specific deductions or benefits being reported. The decision to utilize this box is at the discretion of the employer.

6. Can I receive multiple W-2 forms with different information in Box 14?

Yes, it is possible to receive multiple W-2 forms from different employers, each having their own entries in Box 14. Each employer is responsible for reporting relevant deductions or benefits applicable to the employee, resulting in variations across W-2 forms.

7. Where can I find assistance if I’m confused about Box 14 entries on my W-2?

If you are confused about the entries in Box 14, you can start by discussing it with your employer’s payroll department. Additionally, tax professionals or certified financial advisors can provide guidance on understanding how Box 14 information may impact your taxes or financial situation.