W2 Tax Form 2025 – Many employees may encounter the term S125 on their W2 forms but might not fully understand its significance. This designation refers to a section under the Internal Revenue Code that governs cafeteria plans, allowing you to choose from a variety of benefits, such as health insurance and flexible spending accounts. Understanding how S125 affects your taxable income can help you make informed decisions about your benefits and ultimately maximize your savings. In this post, we will explore the implications of S125 and how it can impact your overall financial picture.

Key Takeaways:

- S125 refers to a section of the tax code that allows employees to pay for certain benefits with pre-tax dollars.

- This section is often associated with cafeteria plans, enabling flexibility in choosing benefits like health insurance or flexible spending accounts.

- Contributions made under a S125 plan may reduce the employee’s taxable income, potentially leading to tax savings.

- Employers report amounts contributed to S125 plans in Box 12 of the W2 form using the code ‘DD’.

- Understanding S125 is important for employees as it impacts both take-home pay and tax filing.

- Employees need to be aware of the specific qualifying benefits offered under S125 to maximize their tax advantages.

- Consulting a tax professional can provide guidance on how S125 affects your personal financial situation.

Understanding the W-2 Form

Before submerging into specifics, it’s important to acknowledge the W-2 form as a vital document for employees in the United States. Issued annually by employers, this form reports your earnings, taxes withheld, and other important information needed for your tax returns. Having a comprehensive understanding of the W-2 ensures you are well-prepared when tax season arrives.

Purpose of the W-2 Form

An important aspect of the W-2 form is its purpose in reporting your income and withholding amounts to the Internal Revenue Service (IRS). It provides both you and the IRS with a clear record of your earnings for the year, which is necessary for calculating your correct tax liability. Additionally, it helps verify that you are complying with tax laws and contributing to Social Security and Medicare.

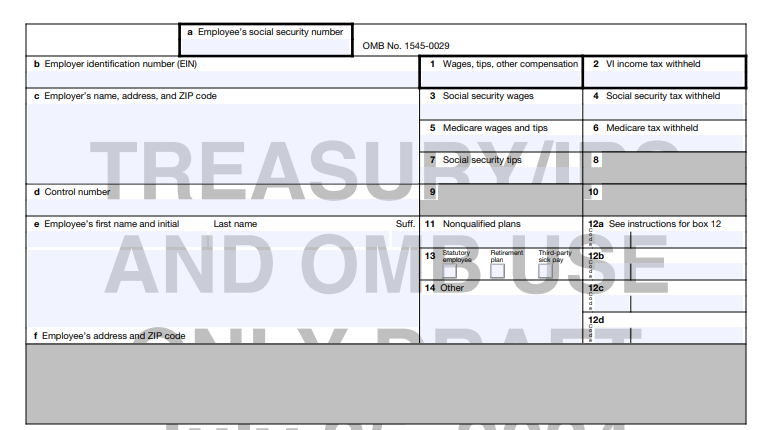

Components of the W-2 Form

An understanding of the components within the W-2 form is vital for accurate tax filing. Your W-2 includes various sections, such as your personal information, employer’s details, taxable wages, tips, and the amounts withheld for federal and state taxes. Each component plays a significant role in determining your overall tax responsibility.

Understanding the individual components of the W-2 form will help you track various income elements. Key sections include Box 1, which shows your total taxable income, and Box 2, reflecting federal income tax withheld. Additionally, Boxes 3 and 4 report Social Security wages and tax withheld, respectively, while Boxes 5 and 6 detail Medicare wages and corresponding tax. Familiarizing yourself with these components allows you to ensure that the figures align accurately, minimizing any potential issues during tax filing.

What is S125?

Assuming you’re familiar with the W-2 form, S125 refers to Section 125 of the Internal Revenue Code, which outlines how certain employee benefits are treated for tax purposes. This section allows employees to choose between taxable wages and non-taxable benefits, making it a beneficial option for those looking to maximize their tax savings while enjoying various fringe benefits offered by employers.

Definition of S125

Above all, S125 plans, also known as cafeteria plans, allow employees to select benefits from a menu of options while offering the advantage of pre-tax deductions. This means that the costs associated with certain benefits, such as health insurance and flexible spending accounts, can be deducted from your paycheck before taxes are applied, effectively reducing your taxable income.

Importance of S125 on W-2

What makes S125 significant is that it impacts how you report your income and tax liability. By utilizing an S125 plan, your W-2 reflects lower taxable income due to pre-tax deductions, which can result in an overall tax benefit, allowing you to keep more of your earnings.

Understanding the importance of S125 on your W-2 form can greatly influence your tax planning strategy. When you participate in an S125 cafeteria plan, the benefits you receive are exempt from Social Security, Medicare, and federal income taxes. This can lead to substantial savings, especially if you contribute to health insurance premiums or a flexible spending account. Ultimately, navigating the S125 benefits can empower you to make informed decisions about your compensation and tax obligations, potentially enhancing your financial well-being.

Benefits of S125 Plans

Keep in mind that S125 plans offer various benefits, enhancing your overall compensation package. These plans allow employees to choose tax-free benefits from pre-tax income, ultimately lowering your taxable income and providing substantial financial savings. This flexibility permits you to customize your benefits according to your personal needs and lifestyles, ensuring that you get the most value from your employment benefits.

Tax Advantages

Below, you’ll find that one of the key tax advantages of S125 plans is the ability to reduce your overall taxable income. By contributing to benefits such as health insurance and flexible spending accounts on a pre-tax basis, you can effectively lower your taxable earnings. This can lead to significant tax savings, allowing you to maximize your take-home pay and keep more of your hard-earned money.

Employee Welfare

Benefits of S125 plans extend beyond tax savings to enhancing your overall welfare. You gain increased access to vital benefits that support your health and well-being, leading to a healthier workforce. Additionally, these plans provide options that align more closely with your personal needs, allowing you to use your benefits in ways that directly contribute to your quality of life.

Plus, by participating in an S125 plan, you can enjoy greater access to important health care services and retirement savings options. This flexibility enables you to tailor your benefits to fit your lifestyle, ensuring you and your family can receive the support you need when you need it. Ultimately, investing in S125 benefits promotes not just your financial well-being, but also your overall health and security.

Reporting S125 on the W-2 Form

For accurate reporting, employers should include S125 plan contributions on your W-2 Form, specifically in Box 12. This box will contain a code that indicates the specific deductions for cafeteria plans or flexible spending accounts, allowing for proper identification during tax filing. It’s imperative to ensure that this information is correctly represented, as it directly affects your overall taxable income.

Where to Find S125 Information

About thirty-five percent of employers offer S125 plans, and you can find information regarding your specific benefits on your W-2 Form. Look for Box 12, which will detail the contributions made towards your S125 plan. This information will assist you in determining your tax situation and understanding your overall compensation package.

How S125 Affects Tax Filing

Above all, S125 contributions can impact your tax filings by reducing your taxable income, allowing you to potentially owe less during tax season. This means you may benefit from some tax savings, as you can utilize pre-tax deductions for qualified expenses instead of paying taxes on that income.

It is important to understand that by participating in an S125 plan, you may lower your overall tax liability. The healthcare advantages and other benefits included in the S125 plan could provide significant savings, translating into more disposable income in your pocket. However, failing to report these contributions accurately may lead to potential audits or additional tax complications. Always ensure your W-2 Form reflects the correct amounts and consult a tax professional if you have questions about how your S125 plan impacts your specific tax situation.

Common Questions about S125

Now that you understand S125 plans, you may have some questions about their benefits and functionality. Many individuals wonder how these plans work in relation to their W2 forms and what implications they have for tax reporting. It’s crucial to clarify these common questions to make informed decisions regarding your health benefits and financial planning.

Eligibility for S125 Plans

Eligibility for S125 plans typically involves being an employee of a company that offers a Section 125 cafeteria plan. You may need to meet specific employment criteria, such as working a minimum number of hours or being a full-time employee. Always check with your employer to understand your eligibility and the benefits available to you.

Misconceptions about S125

To effectively utilize S125 plans, it’s important to clear up misconceptions surrounding them. Many individuals believe that S125 plans are only for certain employees or that they limit benefits. However, this is not the case; S125 plans can apply to a broad range of employees and offer flexibility in choosing benefits.

Considering the misconceptions about S125 plans can lead to confusion regarding your benefits. Some might fear that participating in an S125 plan means losing out on options, which is misleading. In fact, these plans are designed to enhance your choices by allowing you to tailor your benefits to suit your individual needs. Ignoring S125 could mean missing out on potential tax savings and accessing vital health benefits that may otherwise be unavailable. Understanding these details is fundamental to maximizing your overall benefits package.

To wrap up

Upon reflecting on what S125 on your W2 form signifies, you gain insight into how your employer offers benefits that allow you to pay for certain expenses with pre-tax dollars. This section pertains to the premium conversion plans for health insurance, enabling you to potentially lower your taxable income. Understanding this can not only help you better manage your finances but also empower you to make more informed decisions regarding your benefits and tax filings in the future.

FAQs

1. What does the S125 code on the W2 form signify?

The S125 code on the W2 form typically refers to Section 125 of the Internal Revenue Code, which allows for pre-tax benefits, such as contributions to health insurance premiums or flexible spending accounts. These benefits can reduce an employee’s taxable income.

2. How does S125 impact my taxable income?

When you participate in a Section 125 plan, the pre-tax contributions you make for benefits covered under the plan lower your taxable income. This can lead to a decreased tax liability at the end of the year.

3. Are all employees eligible for S125 benefits?

Eligibility for S125 benefits can vary by employer and specific plan requirements. Generally, if your employer offers a Section 125 plan and you enroll, you can benefit from the tax advantages associated with it.

4. What types of benefits can be included in an S125 plan?

An S125 plan can include a variety of benefits such as group health insurance, dental insurance, vision insurance, flexible spending accounts (FSAs), and health savings accounts (HSAs). Each employer’s plan may differ in terms of what is offered.

5. Will I see S125 reflected on my W2 form?

Yes, if you have participated in a Section 125 plan, your W2 form will typically reflect the total amount of pre-tax contributions under the S125 code, which can help you track your benefits and tax savings.

6. Can I change my contributions to an S125 plan at any time?

Generally, you can only change your contributions to a Section 125 plan during the open enrollment period or if you experience a qualifying life event, such as marriage, divorce, or the birth of a child. Check with your employer for specific policies.

7. What happens if I withdraw from S125 benefits? Am I penalized?

If you withdraw from an S125 plan or discontinue your contributions, you typically won’t face penalties, but you will also lose the tax advantages associated with those contributions. Your future taxable income may increase because you are no longer reducing it through pre-tax benefits.