W2 Tax Form 2025 – Over the next few months, you may find yourself wondering when your employer will send out your W2 form. This important document outlines your earnings and tax withholdings for the previous year, and you’ll need it to file your taxes accurately. Typically, companies are required to send out W2 forms by January 31st of each year, ensuring you have the necessary information to meet your tax deadlines. Understanding this timeline can help you plan ahead and avoid any last-minute surprises when tax season arrives.

Key Takeaways:

- W2 Deadline: Companies must send out W2 forms to employees by January 31st of each year.

- Filing Taxes: W2 forms are necessary for employees when filing their federal and state tax returns.

- Employee Notification: Employers typically notify employees about W2 availability in advance, often through email or company portals.

- Late Filings: If W2 forms are not received by mid-February, employees should reach out to their employer.

- Electronic Delivery: Many businesses offer electronic W2 forms, which employees can access through online platforms.

- Corrections: If there are errors on a W2 form, employers are responsible for issuing corrected forms known as W2c.

- Importance of Accuracy: Employees must ensure W2 information is accurate, as it affects tax withholdings and potential refunds.

Importance of W-2 Forms

Before you file your taxes, understanding the significance of W-2 forms is crucial. These forms provide a comprehensive summary of your annual earnings and the taxes withheld throughout the year. They are vital for filing your income tax return accurately and ensuring you pay or receive the correct amount of tax. Having your W-2 forms in order allows you to navigate tax season smoothly and helps you keep track of your financial health.

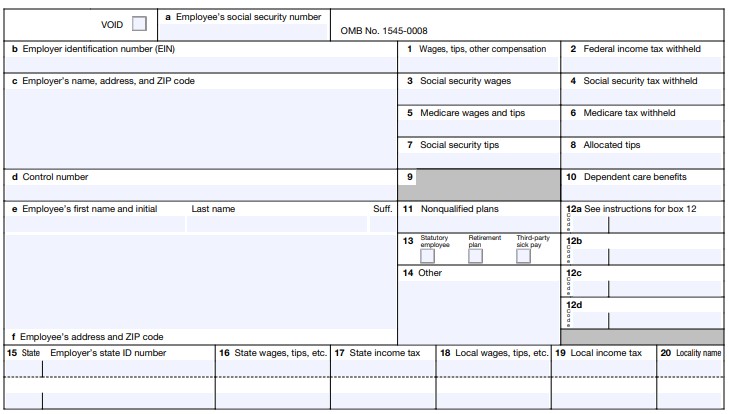

Overview of W-2 Forms

Along with being a legal requirement for employers, W-2 forms serve as a formal document that reports your earnings and tax contributions. Each January, your employer must provide you with a W-2, detailing how much you earned in the previous year and what was taken out for federal and state taxes, Social Security, and Medicare. This form is crucial for your tax filing, allowing you to report your income accurately.

Legal Requirements

To comply with federal regulations, employers are mandated to issue W-2 forms to their employees by January 31 each year. This obligation ensures that employees receive their earnings information promptly to prepare their tax returns. Failure to provide these forms on time can lead to penalties for your employer and create complications for your tax filing.

Understanding the legal requirements surrounding W-2 forms is important for both you and your employer. The Internal Revenue Service (IRS) requires employers to provide copies to employees and submit them to the Social Security Administration. This process is not just a formality; it helps maintain the integrity of the tax system and ensures that your income and tax payments are accounted for accurately. If your employer fails to meet these obligations, you may encounter issues with your tax return or even face discrepancies in your reported income.

Timing for Sending W-2 Forms

Even though W-2 forms are vital for your tax filing, they are not sent out randomly. Companies generally adhere to a specific timeline to ensure you receive your form in time for tax season, usually by the end of January.

Annual Deadline for Employers

Annual deadlines for employers require that all W-2 forms be postmarked by January 31. This allows you ample time to prepare and file your taxes accurately.

Early Distribution Practices

Behind some companies’ early distribution practices lies an effort to enhance employee satisfaction and ensure they have their necessary documentation before tax season.

Early distribution of W-2 forms can be beneficial, giving you more time to review your earnings and withholdings. However, it’s imperative to verify that the information is accurate and complete. Receiving your W-2 ahead of the standard deadline might also lead to concerns if your employer makes late adjustments to your tax information. Ensure that you keep an eye on any subsequent communications from your employer to avoid misunderstandings.

Methods of Delivery

For many employees, the method of delivery for W2 forms can significantly impact their overall experience during tax season. Companies typically choose between physical mail and electronic delivery, each with its pros and cons. The decision often hinges on company policy, employee preferences, and technological capabilities.

Physical Mail vs. Electronic Delivery

Behind the scenes, organizations weigh the advantages of physical mail against electronic delivery. While physical mail ensures that you receive a tangible document, it can also result in delays or potential loss. Conversely, electronic delivery is generally faster, allows for easier storage, and can reduce paper waste, making it a popular choice.

Employee Preferences

Electronic delivery is gaining traction among employees who appreciate quick access to their W2 forms. Many prefer the convenience of receiving their documents directly in their email or through secure online portals, allowing for better organization and faster tax preparation.

Considering factors like accessibility, speed, and environmental impact, it’s clear that employee preferences play a vital role in how W2 forms are delivered. Costs for companies also factor into the decision; electronic methods can reduce print and mailing expenses. However, it’s necessary to consider security and the risk of identity theft when opting for electronic delivery, as personal information must be carefully protected.

Common Issues and Errors

All employees should be aware that issues and errors can arise when receiving W2 forms. These discrepancies can hinder your ability to accurately file your taxes, potentially causing stress or delays. It’s important to review your W2 as soon as you receive it to ensure the information is correct, so you can address any problems promptly.

Discrepancies in Information

After receiving your W2 form, the first step is to verify the information against your records. Look out for misspellings, incorrect Social Security numbers, or inaccurate earnings. These discrepancies can lead to audit issues or delays in tax processing. Ensuring all details are accurate is imperative for a smooth filing experience.

Solutions for Errors

Errors on your W2 form can complicate your tax filing process. You should contact your employer immediately to report any inaccuracies. Your employer is responsible for issuing a corrected W2 form, known as a W2c, which reflects the accurate information. It’s important that you keep a copy of both forms for your records. Once the corrected form is received, you can proceed to file your taxes correctly, avoiding potential penalties.

Information regarding discrepancies and errors on your W2 is key to a hassle-free tax season. Ensure you stay proactive by checking your form for mistakes and addressing them swiftly with your employer. Filing your taxes accurately is critical to maintaining a healthy relationship with tax authorities, so take the necessary steps to resolve any issues promptly. This approach will ultimately lead to a smoother experience and help you avoid potential financial setbacks.

What to Do If You Haven’t Received Your W-2

Not receiving your W-2 can be concerning, but don’t panic. First, ensure that your employer has your correct mailing address and that they sent the form by the deadline. If you still haven’t received it, there are steps you can take to resolve the issue and file your taxes accurately.

Contacting Your Employer

Among the first actions you should take is to reach out to your employer’s payroll or human resources department. They can confirm whether your W-2 was sent, and if not, they can provide you with a duplicate copy or another solution. Be clear about your situation and provide any necessary information they might need.

Filing Taxes Without a W-2

Filing your taxes without a W-2 is possible, but it requires some caution. You will need to use other income records, such as pay stubs or bank statements, to estimate your earnings for the year accurately.

It’s important to keep in mind that if you file based on estimates, you may face penalties if the figures are significantly off. To avoid complications, always attempt to obtain the official W-2 first, and if that fails, accurately report your income from the alternative documents you have. Additionally, you should file Form 4852, which serves as a substitute for the W-2. This form can help report income to the IRS if you are unable to receive your W-2 from your employer.

FAQs About W-2 Forms

Despite the common understanding of W-2 forms, many individuals still have questions about their specifics and handling. These forms are imperative for reporting income and taxes withheld, and knowing the timeline and details surrounding them can help you file your taxes accurately and timely.

Frequently Asked Questions

One issue frequently encountered is the timing of W-2 distribution. Employers are required to send these forms to you by January 31st of each year, ensuring you have enough time to complete your tax return. If you haven’t received yours, it’s important to contact your employer immediately.

Resources for Further Information

Any further questions or concerns about W-2 forms can be addressed through reliable resources. The Internal Revenue Service (IRS) provides comprehensive guidance on their website, where you can find detailed instructions and answers to common queries regarding your W-2 forms.

Frequently, you might find yourself in need of additional information beyond what your employer supplies. The IRS website serves as a valuable tool, offering in-depth explanations on topics like how to read your W-2, what to do if it’s incorrect, and your obligations as a taxpayer. Resources such as tax preparation software and local community tax assistance programs may also provide you with the help you need to navigate your tax situation confidently.

Ultimately, you can expect companies to send out W-2 forms by January 31st of each year, which gives you ample time to file your taxes. It’s crucial to stay vigilant and ensure that you receive your W-2, as you’ll need it to accurately report your income. If you have not received it by mid-February, you should contact your employer to rectify the situation. Being proactive helps ensure a smooth filing process and keeps your financial affairs in order.