W2 Tax Form 2025 – Forms are an imperative part of your tax preparation process, and knowing where to obtain your W2 forms online can streamline this task. You can find W2 forms through your employer’s online payroll system, which is typically the most reliable option. Additionally, IRS.gov provides downloadable W2 forms that you can fill out, but be cautious of scams when searching for third-party sites. Utilizing these trustworthy sources not only saves you time but also ensures you’re using the correct documentation to file your taxes accurately and efficiently.

Key Takeaways:

- IRS Website: You can obtain W-2 forms directly from the IRS official website, which provides access to tax forms and instructions.

- Payroll Service Providers: Many payroll companies offer W-2 forms online for employees; check with your employer if they work with one.

- Tax Preparation Software: Various tax software applications often include features to access and file W-2 forms as part of their service.

- State Revenue Departments: Some state government websites provide access to W-2 forms specific to your location and employment.

- Previous Employers: If you need W-2s from past employers, you can request them directly from the HR department or payroll contact.

- Electronic Delivery Options: Many companies now provide electronic W-2s, which can be accessed via email or secure company portals.

- Tax Professional Assistance: Consider consulting a tax professional if you have difficulties locating your W-2 forms online.

Understanding W-2 Forms

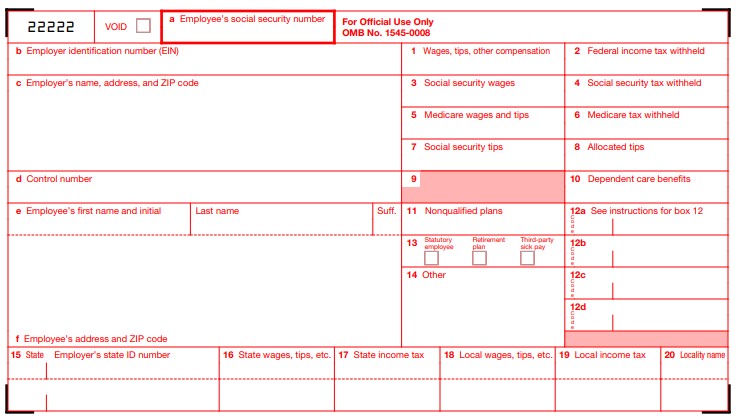

To navigate the world of tax filings, it’s necessary that you understand what W-2 forms are and how they impact your financial responsibilities. The W-2 form is a document that reports an employee’s annual wages and the amount of taxes withheld from their paycheck. Employers are required to provide you with this form by the end of January each year, ensuring you have the necessary information to file your taxes accurately.

What is a W-2 Form?

Understanding the W-2 form is key for any employee. The W-2 form details your earnings and taxes paid throughout the year, making it vital for accurately reporting your income during tax season. This document includes important information such as your Social Security number, your employer’s details, and your total wages, allowing you to clarify your financial standing.

Importance of W-2 Forms

Above all, W-2 forms are necessary for your tax filings. They not only confirm your income but also validate the amount of taxes you’ve paid, which can significantly affect your refund or tax liability. Without this crucial form, you may face delays or complications in processing your tax return.

And understanding the importance of W-2 forms can save you from unnecessary troubles. If you fail to report your income accurately or neglect to include your W-2, you may encounter serious issues with the IRS, including potential audits or delays in your refunds. Additionally, by using your W-2 information, you can optimize your tax returns, potentially allowing you to receive a larger refund or reducing the amount you owe. Always ensure you have your W-2 on hand when preparing your taxes for a smooth filing experience.

Official IRS Resources

You can access official IRS resources to obtain your W-2 forms securely. The IRS provides various tools and options to help you find or request these forms directly from them, ensuring you have the accurate documents needed for filing your taxes.

Accessing W-2 Forms on the IRS Website

Forms are not available for direct download on the IRS website due to privacy and security concerns. However, you can access helpful information and resources that guide you in obtaining your W-2 forms from your employer or other authorized sources.

Requesting Duplicate W-2 Forms from the IRS

Across situations where your employer doesn’t provide your W-2, you can request duplicate copies directly from the IRS. This is typically done if you haven’t received your W-2 by mid-February or if it was lost in the mail.

It is important to act promptly when requesting a duplicate W-2 form from the IRS. You can do this by submitting Form 4506-T, which allows you to request a transcript of your W-2. Ensure you provide your personal information accurately to prevent any delays. The IRS can help you obtain your W-2, but keep in mind that this process may take 5-10 days. If you face further complications, don’t hesitate to contact the IRS directly for assistance.

Online Payroll Service Providers

Many individuals and businesses utilize online payroll service providers to streamline their payroll processes, including the issuance of W-2 forms. These platforms often simplify tax season for employers and employees alike, reducing the hassle of paper forms while ensuring compliance with IRS standards.

Popular Payroll Services Offering W-2 Forms

Services like ADP, Gusto, and Paychex stand out as popular payroll solutions that efficiently provide W-2 forms for their users. Each of these platforms offers comprehensive features allowing you to manage your payroll effortlessly while ensuring W-2s are generated accurately and submitted on time.

How to Obtain W-2 Forms Through Payroll Providers?

Through your selected payroll service provider, obtaining your W-2 forms is typically a straightforward process. You can access your forms directly from the provider’s online portal, often as part of year-end reporting features. Moreover, they may provide electronic delivery options, allowing for quick and secure access to your documents.

Indeed, many payroll service providers also offer automatic updates to ensure your W-2 forms are compliant with the latest tax regulations. You can easily download or print your forms from their platforms. Just make sure to verify your information for accuracy to avoid any potential discrepancies with the IRS. Additionally, some services may offer guidance or support should you need assistance in accessing your W-2 forms, which can be beneficial as you navigate tax season.

Employer Resources

Your journey to obtaining your W-2 forms can often begin with your employer. Many companies now provide online access to these documents, which can streamline the process and save you time. Make sure to check your employer’s internal portal or reach out to the HR department for guidance on how to retrieve your W-2 forms digitally.

Requesting W-2 Forms from Your Employer

To obtain your W-2 form, you should contact your employer’s HR department directly. Make a clear request, specifying the tax year for which you need the form. Providing your details upfront will expedite the process, ensuring you receive your W-2 in a timely manner.

What to Do If Your Employer Is Unresponsive?

With situations where your employer may not respond to your W-2 requests, it’s important to take further steps. You can gather documentation of your attempts to communicate and consider reaching out to the IRS for assistance if the situation remains unresolved. Understanding your rights and the deadlines for filing taxes will help you navigate this challenging scenario.

Requesting your W-2 can feel stressful if your employer does not respond. First, make sure you have documented your communication attempts, as this will be valuable if you need to escalate the issue. If your employer remains unresponsive, reach out to the IRS by calling them at 1-800-829-1040. They can offer guidance and assist you in getting a copy of your W-2 or help with alternative options. Taking action quickly ensures you can meet your tax filing obligations on time.

Third-Party Websites

Despite the convenience of accessing W-2 forms through third-party websites, you should approach this option with caution. While these platforms can often provide quick and easy access to your tax forms, it’s vital to ensure they are legitimate and trustworthy to protect your sensitive information.

Reputable Third-Party Websites for W-2 Forms

One option you can consider is websites like H&R Block, TurboTax, or TaxAct. These reputable platforms not only help you access your W-2 forms but also offer additional resources for filing your taxes efficiently and securely.

Risks of Using Unofficial Sites

Among the dangers of using unofficial sites are potential breaches of your personal and financial information. Fraudulent websites often trick you into sharing your sensitive data, which can lead to identity theft or financial loss.

Forms obtained from unofficial sites may not be legitimate and could contain incorrect information, jeopardizing your tax filing and causing disputes with the IRS. Additionally, submitting your sensitive data on these sites increases the risk of malware and phishing attacks that can compromise your whole financial profile. Protect yourself by ensuring you only use trusted and verified platforms for accessing your W-2 forms.

Tips for Ensuring Accuracy

For ensuring the accuracy of your W-2 forms, it’s imperative to follow these tips:

- Verify all personal information such as your name and Social Security number.

- Check that your income and tax withholdings are correctly reported.

- Review the employer’s identification details for correctness.

Thou can avoid potential issues with your taxes by remaining vigilant and double-checking everything.

Double-Checking Your W-2 Information

Before filing your taxes, thoroughly review your W-2 information for any discrepancies. Cross-reference the details with your pay stubs to ensure everything aligns correctly. Pay special attention to your income, tax withholdings, and any deductions or benefits that could affect your tax situation.

Steps to Take if Information is Incorrect

Tips for handling discrepancies include contacting your employer and requesting a corrected W-2. If the information is still wrong after communicating, you can file a Form 4852 with the IRS as a substitute, explaining the situation.

Take immediate action if you find incorrect information on your W-2 form after filing. First, reach out to your employer or the payroll department to request a correction. If they fail to provide an updated form, it becomes imperative to file a Form 4852 with the IRS. This form acts as a substitute for your missing W-2, but be prepared to supply your best estimates of your income and taxes paid. Delaying action can lead to penalties or complications with your tax return, so act swiftly to safeguard your financial interests.

Conclusively, you can obtain your W2 forms online through several reliable sources, including your employer’s payroll portal, the IRS website, and various third-party tax preparation services. Make sure to log into your employer’s system or check the IRS site based on your needs. Additionally, if you’re experiencing difficulties, consider reaching out to your employer’s HR department for assistance. By knowing where to find your W2 forms, you can ensure a smoother tax filing process.

FAQ

1. What are W2 forms?

A: W2 forms, also known as Wage and Tax Statements, are official documents provided by employers to report an employee’s annual wages and the amount of taxes withheld from their paycheck. They are typically issued at the end of the tax year and are necessary for filing federal and state tax returns.

2. Where can I find W2 forms online?

W2 forms can be found online through various sources, including your employer’s payroll portal, the IRS website, and tax software programs. Companies often provide online access to W2 forms for their employees, so checking with your employer is a good first step.

3. Can I download my W2 form directly from the IRS website?

No, while the IRS provides information about W2 forms, you cannot directly download your specific W2 form from their website. You need to obtain it from your employer or through online payroll services that maintain your tax records.

4. What if I cannot access my W2 form online?

If you are unable to access your W2 form online, you should contact your employer’s HR or payroll department for assistance. They can provide you with a copy or help you with the necessary steps to obtain it.

5. Are there any online services that allow me to obtain W2 forms for previous years?

Yes, there are online services that specialize in recovering past W2 forms, such as online tax filing platforms or financial document retrieval services. Some may charge a fee for their services, so be sure to research and choose a reputable provider.

6. Is it safe to enter my personal information when requesting my W2 online?

It is generally safe to enter your personal information on trusted employer or tax service websites that use secure connections (look for HTTPS). However, be cautious and avoid entering personal details on unfamiliar or suspicious sites to protect your information from fraud.

7. What should I do if my W2 form is incorrect?

If your W2 form contains incorrect information, such as your name, Social Security number, or earnings, you should notify your employer immediately. They are responsible for issuing a corrected W2 form, known as a W2c, to ensure your tax records are accurate.